Financing the Future 2015: Some Hits and Misses on the Future of Development Finance’

A few weeks ago, an Overseas Development Institute-led consortium of partners hosted a wide range of organizations and Governments for an event entitled “Financing the Future.” In essence, the purpose of this event was to collect feedback and share thoughts on the the “zero draft” of the Financing for Development (FfD) outcome document which hit during the event, with the final draft to be negotiated in Addis Ababa in July. The document identifies commitments and actions needed to finance the post-2015 development agenda, including the ambitious Sustainable Development Goals (SDGs), now under negotiation.

The event also brought to the forefront what was referred to as the “30-30-130” challenge. Approximately 190 countries that will negotiate the next development agenda later this year, 30 will likely be “chronic donors”, 30 will likely remain aid-dependent until 2030, and 130, the large majority, will not be either. The challenge will be to reach a lasting consensus among a majority of countries that feel they stand to benefit from the proposals put forward in Addis.

The FfD agenda is broad. It spans Official Development Assistance (ODA), private sector programs, extractive industries, remittance flows, government budgets, and beyond. The breadth of the agenda often means that participants are either spread thin, with little opportunity to dive deep into each funding flow or challenge, or are deep in one area (e.g., ODA, Domestic Budgets) with little visibility of the wider agenda. This event favored the broad-based approach, attempting to cover the expansive agenda holistically, and often succeeded. Here are a few things we thought were hits, and what we thought was missing from the conversation.

Hits

- The “Missing Middle”. There are funding challenges of growing from a least development country (LDC) to lower-middle income country (LMIC). The recent ODI report on FfD highlights the public financial management hurdles a country faces as they grow from an LDC to LMIC. These newly “graduated” countries have diminished access to concessional funding sources, but do not yet generate enough tax revenue to close the funding gap. This can be particularly acute as new LMICs often prioritize expensive infrastructure programs (e.g. port expansion, road development, energy sector expansion) and may only have access to high interest rate loans, with shorter repayment, and significant exchange rate risk. Several calls for revisiting the financing framework for transitioning countries and expanded multilateral development bank non-concessional funding (e.g. via the World Bank’s IBRD arm) were made during the event.

- Aid is not dead, but it is changing. Perhaps the most surprising element of the conference was the strong focus on official development assistance (ODA). Strong calls were made for countries to fulfill their committed target of 0.7% of GDP and to direct more aid towards LDCs and fragile states. A common refrain: the critical role of the aid effectiveness agenda, including prioritizing use of country systems, programming ODA through national budgets, increasing predictability and aligning assistance with national priorities.

- Realistic expectations of private sector contributions to sustainable development. During a “speed geeking” session, Patrick Fine of FHI360 showed a striking chart demonstrating that, while private sector flows are critical for middle income countries (MICs), least developed countries (LDCs) are still heavily dependent upon aid, with over 50% of their external resources coming from ODA. The ongoing debt challenges of the Government of Ghana – a country that recently graduated to lower-middle Income status – underscored how predatory lending from the private sector can cause serious public financial management challenges for growing economies.

Perhaps the key change from years past was positioning ODA as a catalytic endeavor. For example, how can targeting assistance to strengthen a country’s tax system improve domestic resource mobilization, or help identify “bankable projects” to attract complementary private sector financing.

What was missing?

- Building without BRICS. Having a FfD discussion with no direct engagement from the BRICS (particularly China) is, sadly, not surprising in 2015. However, while China’s literal absence was expected, its relative absence from the discussion and from the FfD draft document was a surprise. When China was mentioned, it was largely as a caricature of easy money attempting to take advantage of Africa’s natural resources, rather than as a legitimate development partner providing tens of billions of dollars in assistance per year. Case in point: walking from the conference venue to our hotel past Burma Camp Road, one saw the repaving project being supervised by several Chinese foremen. China.aiddata.org shows over $4 billion USD in funding from China to Ghana from 2010-2013 alone. If we’re going to be serious about FfD in Africa, China needs to be taken more seriously into consideration, if not present in the negotiations themselves. There were some calls during the event to recognize China’s development contributions, particularly their investments in road and railroad infrastructure, yet the discussion also centered on how to ensure China is accountable for what they finance. This dialogue will likely not succeed in bringing them to the table and ensuring their voice is factored in the upcoming negotiations.

- The Data Revolution. Quite surprisingly, the issues of monitoring the sustainable development goals (SDGs) and building statistical capacity came up only once throughout the conference, in passing. The most recent estimates from the United Nations Sustainable Development Solutions Network (UNSDSN), Open Data Watch, and others suggest that at least another $200 million per year will be needed to fund proper SDG monitoring, with total estimated costs of $1 billion per annum. There is a clear role for ODA, particularly in the short term, to help address this gap. However, events on the Data Revolution in Africa feature a largely different set of actors, illustrating the real risk that the FfD and SDG agendas are not mutually supportive. To have a “World that Counts”, we need the Financing to count it.

- Clarity on the definition of ODA or the role of the International Aid Transparency Initiative (IATI) and Aid Transparency. In line with the growing complexity of the development finance landscape, much of the discussion centered on how we should define and measure development finance, and in particular how to count ODA as opposed to other official loans that do not qualify as ODA according to the OECD’s Development Assistance Committee (DAC). Debates over whether to broaden (e.g., to include non-DAC donor flows) or narrow the definition of ODA (e.g., no longer including climate mitigation activities), more or less agreed that current measures are not capturing the true picture of development resources available to countries. This should outline a clear role for IATI in addressing gaps in development assistance data, and yet IATI will likely not factor in the FfD negotiations. While the current FfD draft calls for greater transparency of development activities in a standardized, open format, no explicit mention is made of IATI nor the concrete actions and commitments needed to achieve this. Annelise Parr (UNDP, IATI Secretariat) made a convincing plea for the inclusion of the IATI approach to publishing timely, comprehensive and forward-looking aid data in the FfD document, yet the majority of participants did not consider this a top priority. This could signal continuing challenges for the aid transparency agenda post-2015, particularly in getting countries and organizations to meet their commitments to reporting high quality aid data.

What’s next?

With the release of the “zero draft”, donors, governments, scholars, and advocacy groups alike are beginning to weigh in on what is missing or weak in the current draft. An updated draft will be circulated in advance of July’s FfD summit, which will draw some of the top policymakers from developed and developing countries, multilateral development banks, civil society, and the private sector to determine how FfD can contribute to kick-starting the era of sustainable development.

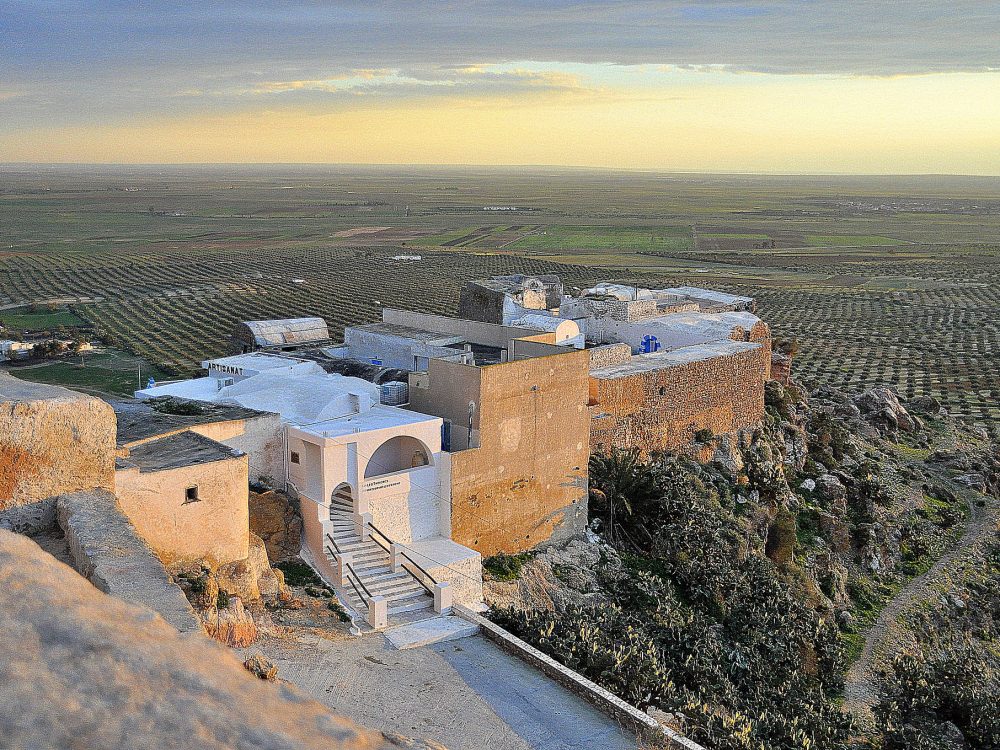

This piece was originally posted on the First Tranche. Image from @AectForAfrica.

Share This Post

Related from our library

How Useful Is AI for Development? Three Key Lessons

The development world is buzzing with excitement over the idea that new and emerging applications of AI can supercharge economic growth, accelerate climate change mitigation, reduce inequalities, and more. But what does this look like in real life?

At a Glance | Tracking Climate Finance in Africa: Political and Technical Insights on Building Sustainable Digital Public Goods

In order to combat the effects of climate change, financing is needed to fund effective climate fighting strategies. Our white paper, “Tracking Climate Finance in Africa: Political and Technical Insights on Building Sustainable Digital Public Goods,” explores the importance of climate finance tracking, common barriers to establishing climate finance tracking systems, and five insights on developing climate finance tracking systems.

AMP Through the Ages

15 years ago, AMP development was led by and co-designed with multiple partner country governments and international organizations. From a single implementation, AMP grew into 25 implementations globally. Through this growth, DG has learned crucial lessons about building systems that support the use of data for decision-making.