What Can West Africans Do With Their Procurement Data?

At the Africa Open Data Conference this week, Development Gateway will be sharing its experience scoping open contracting readiness in West Africa. Join us on Wednesday 7/19 at 16:00-17:00 in Room 218.

When it comes to understanding government procurement, we need data. And to understand how efficient procurement processes are, we must assess the quality of procurement data: its scope and extent, consistency, and compliance with openness standards. With the right data and good data quality, we can use analytics tools to ensure that governments are delivering for citizens.

So what can we learn about procurement in West Africa, based on data currently collected in 6 countries? Based on our scoping studies conducted with the Open Contracting Partnership, we uncovered what governments and citizens can learn at present, and needed steps to earn even more in the future.

Use Cases for Procurement Data

Any discussion of data use must start with identifying user needs: What do West Africans want to know from their procurement data? Our studies focused on three key stakeholder groups in each country: government officials, civil society, and private sector representatives. Understanding how these particular groups want to use procurement data will help us to identify what data we should seek to collect and publish.

While each country differed, a number of common interests emerged:

- Government officials mentioned combatting corruption as a key use case of procurement data. Officials also expressed interest in ensuring that procurement occurs efficiently; the government gains value for money; and that the procurement market is competitive.

- Civil society often raised issues of equity — understanding who wins procurement contracts, and whether the winners are actually deserving. Many also expressed an interest in combatting corruption, ensuring that suppliers deliver on contracts to the government’s specifications.

- Private sector representatives — paramount to all other issues — wanted to ensure that local suppliers get a fair share of procurement opportunities.

What Data are Procurement Authorities Publishing?

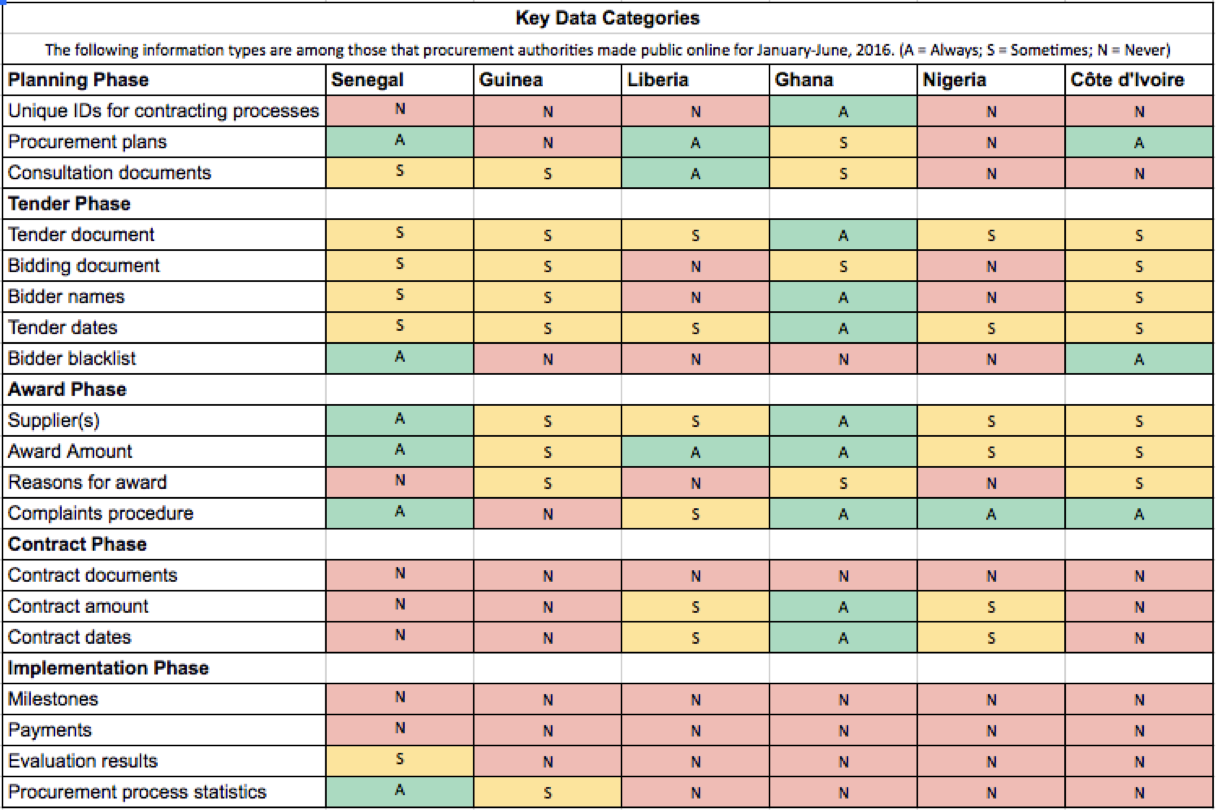

Now that we understand what participants want to learn about their procurement processes, we can review the data for quality and completeness by evaluating the online publication frequency of key data categories during a 6-month period in 2016.*

As evidenced above, even the countries most proactive in disclosing procurement data display noticeable gaps in data publication. Disclosure in the contract and implementation stages — where service delivery and payment take place — is particularly weak; few countries consistently publish data across the tender and award phases, in which procurement authorities tend to have the most data. While Ghana regularly publishes most of the key data from the tender and award categories, and Senegal is also consistent in its publication of most of the key award data, no other country consistently publishes data related to these key phases. As a result, many citizens might be unaware of which tendering opportunities are available and which companies have won.

On the issue of data quality, our researchers observed that most countries do not make full use of unique identifiers. These unique identifiers help link procurement processes across phase, and identify procuring entities, suppliers, or items purchased. Finally, — with the exception of Nigeria, which is now working to publish data in the Open Contracting Data Standard — procurement data is largely still published in HTML or PDF. A lack of open, structured data makes it difficult for users to run their own analyses and searches.

What We Can Do With This Data

Given the quality and completeness of procurement data in West Africa, how can we best respond to user needs?

Procurement efficiency and effectiveness: Some key dates and amounts related to the tender and award phases are available. Using these, we can answer several valuable questions, such as how long the procurement process takes, whether government is purchasing below estimated value, and by how much. However, essential questions of competitiveness — such as the average number of suppliers bidding, or the average amount of a specific product — are in many cases still unanswerable. Finally, our ability to evaluate the data on a more granular level (i.e., by item or procuring entity) is also limited.

Corruption risk: Some of the countries studied have supplier databases, with limited information about suppliers and performance. Joining this information with award data and complaint information provides some opportunity for analysis. Answerable questions could include:

- Are complaints more likely when certain suppliers are bidding?

- Do some suppliers win more frequently from specific procuring entities than others?

- Does supplier contact information match that of procuring entities, or government officials?

Although not publicly available, some countries would be able to benefit from the use of bidding information — including the identities of winning and losing suppliers, as well as bid amounts — that is crucial to collusion analysis, as well as to analytics used to detect fraud and rigging. Where this information is not systematically collected, corruption risk analysis will be hampered.

Understanding local supplier participation: Though limited information about government suppliers is publicly available, some governments in the countries studied do collect supplier data through information management, tax systems, or unintegrated databases. Linking this information to procurement data represents an opportunity to better understand the share and value amount of bidding opportunities won by local suppliers. Other information, such as specific geographic location, could be mapped along with available data about number of contracts won and lost. However, the lack of granular data – and the lack of implementation data – prevents us from gaining more insight into local supplier participation.

Next Steps

There is increasing recognition of the need for better procurement systems, and access to open and structured procurement data, thanks to the work of procurement authorities across West Africa. Nigeria has already begun implementing OCDS, and plans to purchase an e-Procurement system in the near future; Ghana is currently implementing an e-procurement system; and other countries are likely to follow suit. Because many of these tools collect and store information about procurement as government bodies conduct the procurement process, the tools can significantly improve data collection, leading to more complete and higher quality data. Countries would benefit from adopting tools that fit their procurement needs — whether full e-procurement systems, or lighter e-tender platforms — and incorporating OCDS at the core, to benefit from open source technologies being developed around the standard.

Beyond tools used and policies, procurement authorities should continue engaging with civil society, the private sector, and other government agencies. This engagement — seen in Nigeria, Uganda and other countries — will help procurement authorities both demonstrate and understand procurement data use cases, and can inform the design of e-procurement tools, ensuring that investments in digital tools meet user needs. Collaboration on procurement data use can be a valuable tool for helping governments to meet citizen expectations for improving public services and helping democracy deliver for citizens.

*Note: This research was conducted prior to Nigeria’s publication of its open contracting portal: http://www.nigeriaoc.org/.

Interested in learning more? Check out our other blog post about the challenges faced as West African countries seek to improve their procurement regimes.

Project Team: Ousseynou Ngom, Mark Irura, Vanessa Sanchez, Carmen Cañas, Josh Powell, Andrew Mandelbaum

Image Credit: Jeremy Segrott, CC BY 2.0

Share This Post

Related from our library

Digital Transformation for Public Value: Development Gateway’s Insights from Agriculture & Open Contracting

In today’s fast-evolving world, governments and public organizations are under more pressure than ever before to deliver efficient, transparent services that align with public expectations. In this blog, we delve into the key concepts behind digital transformation and how it can enhance public value by promoting transparency, informing policy, and supporting evidence-based decision-making.

The Future of Technology Governance and Global Development: Why DG Brought DataReady In-house

DG is excited to announce we now have more robust data governance advisory services with the recent integration of DataReady.

Letting the Sunshine in: Building Inclusive, Accountable, and Equitable Climate Finance Ecosystems

In April, DG, HackCorruption, and the Thai Youth Anti-Corruption Network hosted a roundtable in Bangkok to discuss climate financing. This blog explores the main takeaway: a multi-disciplinary and multi-stakeholder approach that prioritizes local contexts, inclusive governance, transparency, accountability, and equitable distribution of resources is essential to impactful climate financing.