Price & Availability: the Impact of Russia’s Invasion of Ukraine on African Fertilizer Markets

Since 2017, AfricaFertilizer.Org (AFO), an initiative of the International Fertilizer Development Center (IFDC), and Development Gateway: An IREX Venture (DG) have partnered on The Visualizing Insights on Fertilizer for African Agriculture (VIFAA) program to address key data gaps. The program works in collaboration with and to support the private sector and government to respond efficiently and effectively to changes in the fertilizer market, ensuring that sufficient quantities and appropriate types of fertilizers reach farmers at the right time for planting.

At the country level, the program has developed fertilizer dashboards in Kenya, Ghana, and Nigeria and is currently working on similar dashboards in Senegal, Malawi, Mozambique, Zambia, and Ethiopia. In response to fertilizer availability challenges in sub-Saharan Africa which are fueled by the ongoing Russian invasion of Ukraine (along with a host of pre-existing factors including COVID-19), VIFAA is now launching the Africa Fertilizer Watch to track regional and country-level market indicators, productivity, and production distortions on food production and agriculture.

Background and Crisis

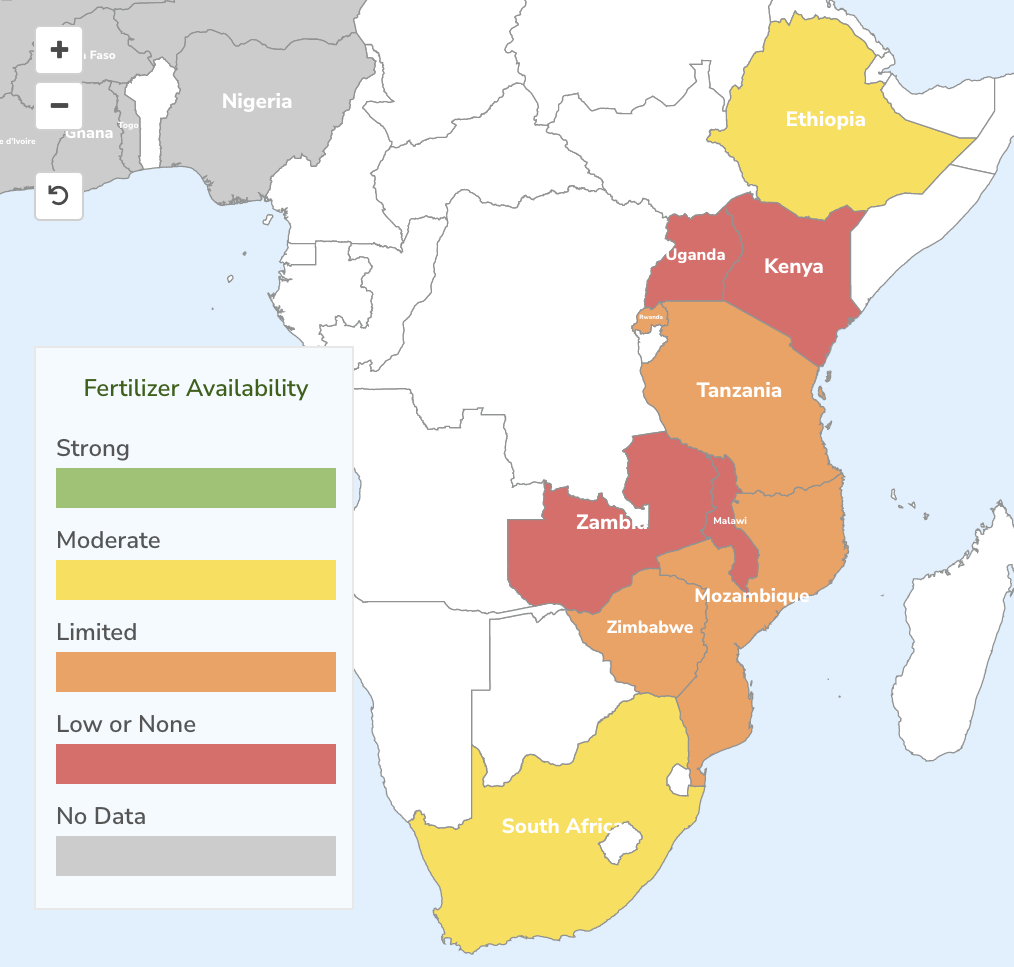

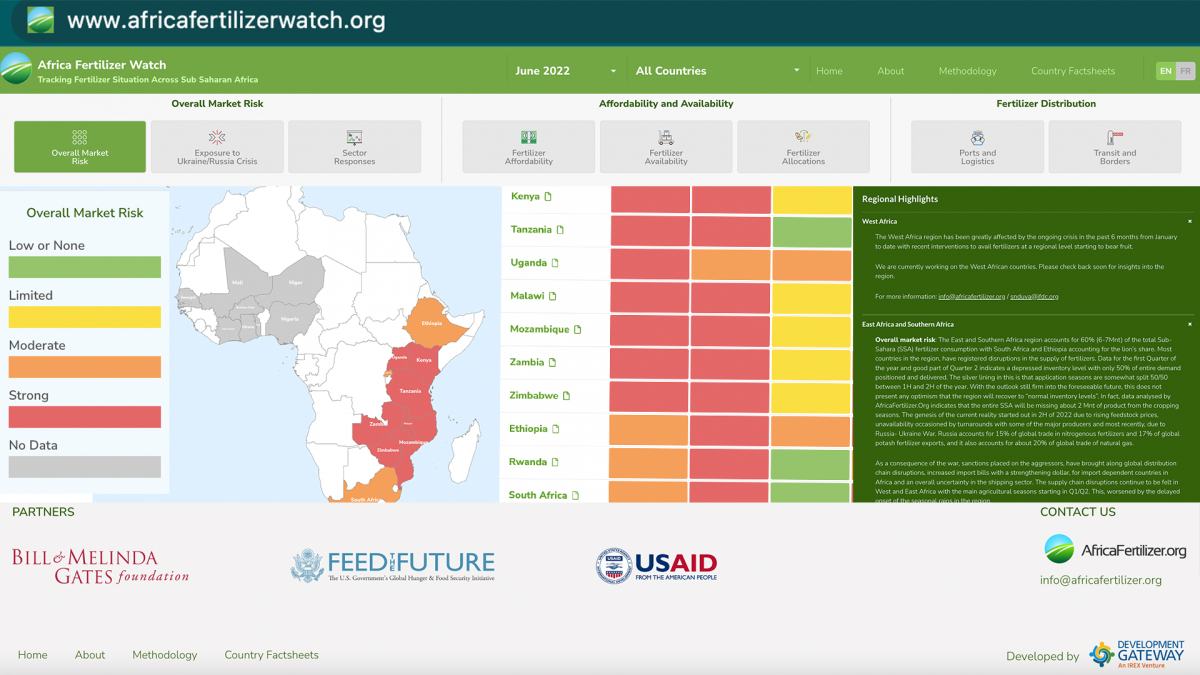

Starting in early 2022, fertilizer prices rose almost 30% due to the Russian invasion of Ukraine. AFO has been tracking data related to price and availability across 20 countries in Africa, and the data shows that fertilizer stocks are problematically low, an urgent issue that was seen during the most recent planting season. The image below shows the levels of fertilizer availability in June 2022, with the majority of countries analyzed having limited or low/none fertilizer supply.

Why Does Fertilizer Matter?

We know that increased fertilizer consumption is one factor that can contribute to food security by improving soil health and increasing crop yields. Prior to the invasion, across sub-Saharan Africa, fertilizer use was already insufficient to replace soil nutrients lost every year to crop production and further constrained by the COVID-19 pandemic.

Eighty percent of the total fertilizer consumed across sub-Saharan Africa is imported. Overall, West Africa accounts for 40% of all fertilizer consumed in sub-Saharan Africa. East and Southern Africa make up the remaining 60%. Nigeria is one of the few countries that does not rely on imports to meet fertilizer demand as they produce 70% of their fertilizer domestically. Currently Burkina Faso, Malawi, Mali, Niger, Sudan, Tanzania, Togo, and Zimbabwe are reporting limited inventory and that they will not be able to meet the needs of farmers in the current planting season. Ghana, Kenya, Nigeria, Mozambique, Zambia, and Malawi (existing VIFAA countries) are also showing a sizable gap in fertilizer supply.

Policymakers must consider how to structure fertilizer subsidies to meet different demand needs across different countries. If the market is adequately subsidized, this usually incentivizes farmers to increase fertilizer use and impacts the amount of fertilizer demanded for each planting season. Whether subsidies in times of crisis have a positive effect on the market depends on a number of factors. Subsidies often distort markets by creating parallel distribution models—subsidized and commercial value chains, often to the detriment of the private suppliers. In times of crisis, the structure of subsidies could be the difference between farmers having enough fertilizer to meet their needs versus experiencing severe shortages. In countries that are subsidizing fertilizer to counter price increases from the Russian invasion of Ukraine, farmers are seeing the benefit.

A Deep Dive

Across sub-Saharan Africa, there are severe shortages of fertilizer coupled with high fertilizer prices. Without interventions, this could have disastrous consequences for food security. An estimate from IFDC shows a fertilizer demand reduction of 30% in 2022 is equivalent to 30 million metric tons (MT) less food produced or the sustenance requirements of around 100 million people. To understand the impacts more clearly, we will use Ghana, Kenya, and Nigeria as illustrative examples – both because of their importance in the African markets and because the VIFAA Dashboards offer a comprehensive picture of the situation.

Ghana

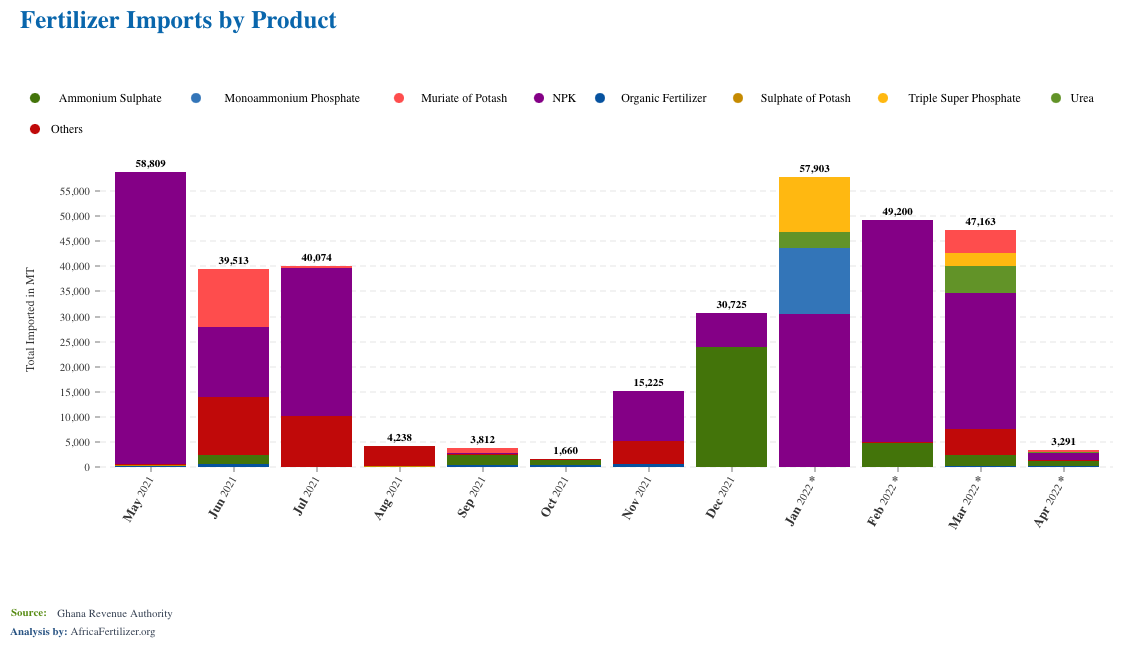

Currently, Ghana is reporting only 38% of the inventory needed toward the total 550kt demand. The Ghanaian market is highly subsidized and was already experiencing a 61% reduction in fertilizer consumption in 2021 as a result of existing supply chain issues. The Russian invasion of Ukraine has further impacted Ghana by decreasing the global fertilizer supply and thus driving up the prices on whatever fertilizers are available on the market. For most farmers, the current prices are out of reach. In the image below, the low levels of fertilizer imports from August to December 2021 were due to supply chain issues related to COVID-19. The significant decrease in imports seen in April (see image below) occurred because of the Russian invasion of Ukraine.

Ghana is particularly reliant on fertilizer from Russia, Ukraine, and Belarus. In 2020, 10% of Ghana’s fertilizer was from the region. That number rose to 18% in 2021 and was at 52% as of May 2022. And as a heavy consumer of NPK (nitrogen, phosphorus, and potassium – key macro-nutrients in crop production), Ghana has been particularly affected.

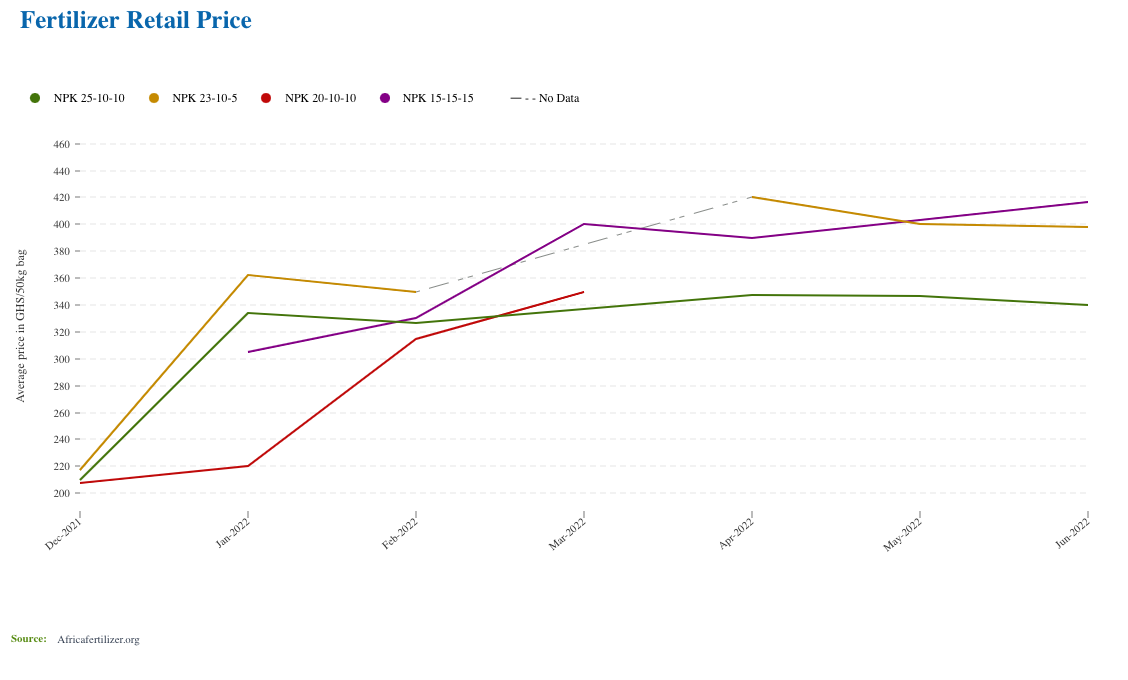

As the invasion of Ukraine continues, high fertilizer prices and limited availability are exposing Ghana to reduced tonnages, leading to reduced consumption figures and subsequently, lower production yields. The image below shows the steady increase in the price of fertilizer after January 2022.

Kenya

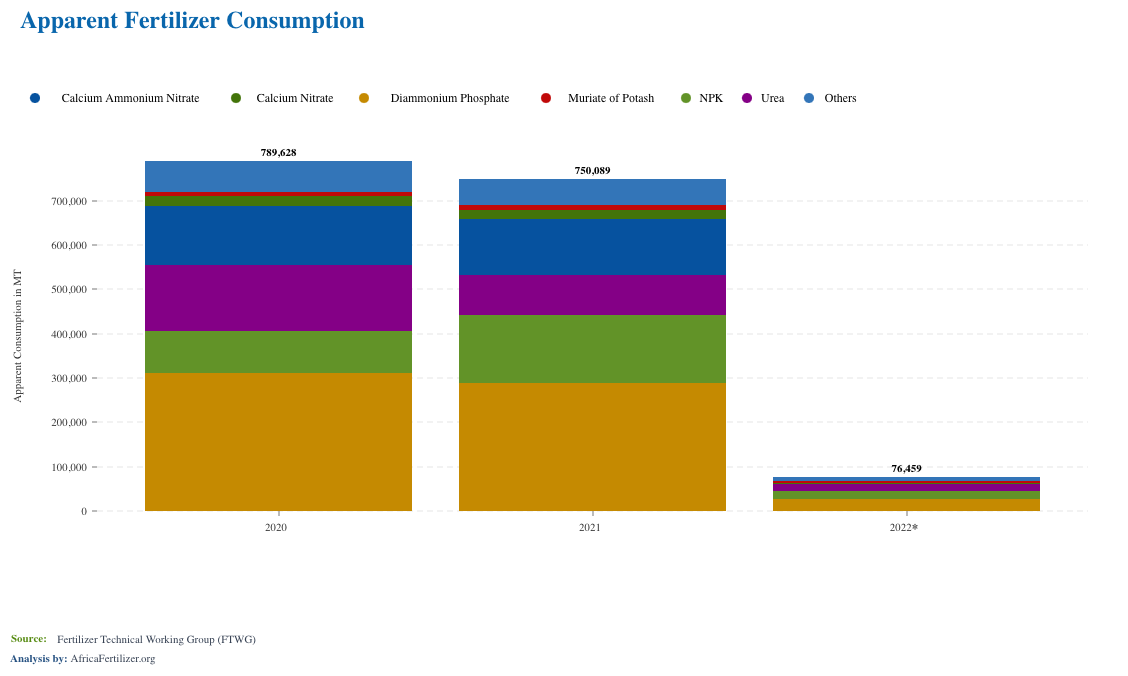

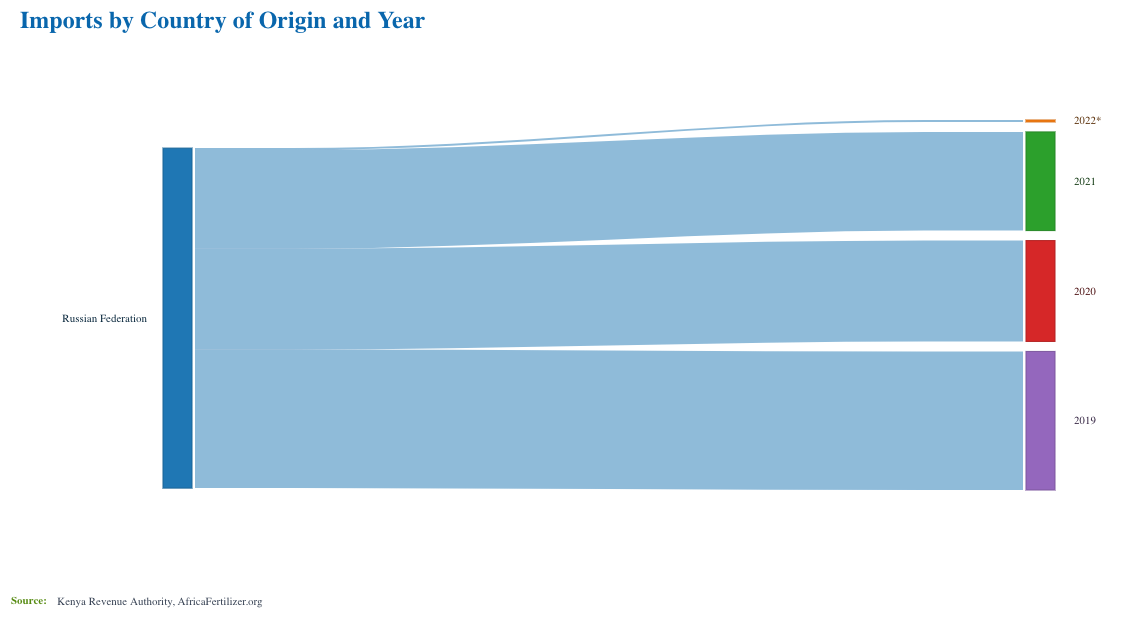

Kenya also has limited access to fertilizer. Like Ghana, Kenya is seeing continued high prices in the fertilizer market. The government has intervened with an emergency subsidy program for 114 KT, but it is unclear if this support is timely enough to address the supply chain issues for the current planting season. The main cropping season in Kenya is May to July. At this point, what has not already been purchased or secured will not be available for the current season. The image below shows the sharp decline in fertilizer consumption in 2022 compared to the previous two years.

Kenya has historically relied on Russia for a sizable proportion of its fertilizer needs, but has had to readjust due to sanctions on Russian exports. In 2022, there was a sharp decline in fertilizer volumes coming from these countries. Kenya has historically imported all of its fertilizer from Russia for tea production. The rise in fertilizer prices globally means Kenya’s other fertilizer requirements are also challenged.

Nigeria

Fertilizer prices have risen in Nigeria, although it remains one of the few countries in the region that is self-sufficient in fertilizer production. Sixty-four percent of the needed inventory is available for the current cropping season, which provides some stability. Nigeria has also been able to hedge extreme price increases due to the existing 6 MT production capacity for urea. Urea traded locally is cheaper than international prices, giving Nigeria an advantage in terms of affordability because of this large production potential. Nigeria also has an established contract with Morocco to trade ammonia for phosphates, ensuring price stability. Eastern Europe supplies a relatively low percentage of fertilizer to Nigeria. Food security is still a major concern as Nigeria is highly dependent on importing food staples such as wheat and rice.

Muriate of potash (MOP) imports are the most affected fertilizer type with limited availability and record high prices. Without MOP, there will be a nutrient imbalance in Nigeria’s fertilizer blends. Nigeria has made strides in fertilizer consumption through the President’s Fertilizer Initiative (PFI). In the past 4 years of implementation (2017 to 2020), the PFI program facilitated the local production and supply of 1.5 million MT of NPK 20:10:10 fertilizer, resuscitated and established 41 blending plants across 17 states, achieved controlled reduction in the price of NPK fertilizer, created over 250,000 direct and indirect jobs across the fertilizer value chain and accrued substantial annual subsidy and FX savings. However, the current shortages and price spikes could put all the gains made at risk.

Areas of Intervention

Without intervention, the fertilizer shortages caused by the Russian invasion of Ukraine will create a food security crisis in sub-Saharan Africa. The markets in this region are severely challenged in securing fertilizer for this cropping season, which will likely mean scaling down the amount of fertilizer used by farmers both because of the high price of existing fertilizer and limited availability. Ultimately, the reduction will be reflected in crop yields during harvest season. Reduced yields could mean both high food prices and increased food insecurity within the region. This problem is exacerbated by overall price inflation and the fact that most African economies are heavily dependent on agriculture.

There are several interventions to consider:

- Temporary Subsidies – Governments could step in with temporary subsidies to stimulate procurement from global suppliers outside of Eastern Europe. Kenya has followed this route by buying fertilizer at a high cost on the global market and then subsidizing the cost for farmers locally. Tanzania is also considering adding subsidies as a feature of their bulk procurement system.

- Financing – Importers in sub-Saharan Africa are reporting that financing is currently the biggest barrier. In 2021, a 30kt Urea vessel cost $9 million. This year the cost is three or four times that amount. Financiers at this level are unable to match the costs and have had to be creative to keep their businesses alive by, for example, importing smaller quantities of fertilizers at a higher price.

- Tracking Market Dynamics – Closely tracking market dynamics including price and availability can help inform policy and business decisions. We encourage all stakeholders to reference the VIFAA dashboards to inform interventions across sub-Saharan Africa.

- Invest in Production Capacity – In the mid- to long-term, investing heavily in production capacity domestically or at the intra-African level could insulate sub-Saharan Africa from future risks associated with net importers. Nigeria is an example of a country that has reduced its risk related to fertilizer supply. Other examples include Morocco as an exporter of phosphates, and potentially, the Democratic Republic of Congo with potash reserves yet to be exploited commercially.

- Nutrient Use Efficiency – Identifying ways to prioritize fertilizer use for the crop value chains with the highest return on investment for farmers. A massive farmer awareness campaign and support to farmer organizations doing outreach could be beneficial.

The Africa Fertilizer Watch: Tracking Fertilizer across sub-Saharan Africa

In the early months of the COVID-19 pandemic, Development Gateway, IFDC, and AFO developed a COVID-19 Fertilizer Watch Dashboard to support the fertilizer supply chain to visualize related data and respond to the crisis. Similarly, we have developed the Africa Fertilizer Watch to visualize indicators related to the current crisis. The Africa Fertilizer Watch Dashboard will focus on key fertilizer market indicators to support development partners’ and the private sector’s efficient and effective responses to the price increases related to the evolving emergencies and ensure that sufficient quantities of appropriate fertilizers reach farmers in time for planting. This early warning system could inform decisions on subsidies, early positioning of cargo from global markets, credit guarantee schemes, development partners involvement through finance mechanisms, or other interventions to protect fertilizer availability. Indicators include overall market risk, exposure related to the Russian invasion of Ukraine, sector responses, affordability, availability, allocations, port and logistics, and transit and borders.

VIFAA Going Forward

In November 2022, AfricaFertilizer (AFO), our partner on the Visualizing Insights on Fertilizer for African Agriculture (VIFAA) program, rebranded and launched a new website. This website includes the integration of country-specific VIFAA dashboards, which were previously housed in separate websites. By integrating the country-specific dashboards as well as fertilizer data on trade, production, consumption, and retail prices for 18 countries in sub-Saharan Africa, the new AFO data allows easier comparative analysis across countries and contributes its quota to the advancement of food security throughout Africa.

We have updated the previous country-specific dashboards links to now redirect you to AFO’s new website in order to ensure you are accessing the most up-to-date resources.