Nigeria’s Changing Fertilizer Sector (Part 1)

In the past decade, there has been over $7 billion worth of private-sector investments into Nigeria’s agriculture sector. Why, and what is the impact of these investments? What does it mean for Nigerian farmers? Just under 95% of those investments came from the fertilizer sector ($6.6 billion). Historically, fertilizer was considered the government’s turf where the Ministry of Agriculture was the buyer (through tenders or contracted suppliers), and the state governments were the primary customer. Thus, in most cases the private sector did not have a strong connection to the smallholder farmer and fertilizer was typically a scarce commodity when the rains began to fall.

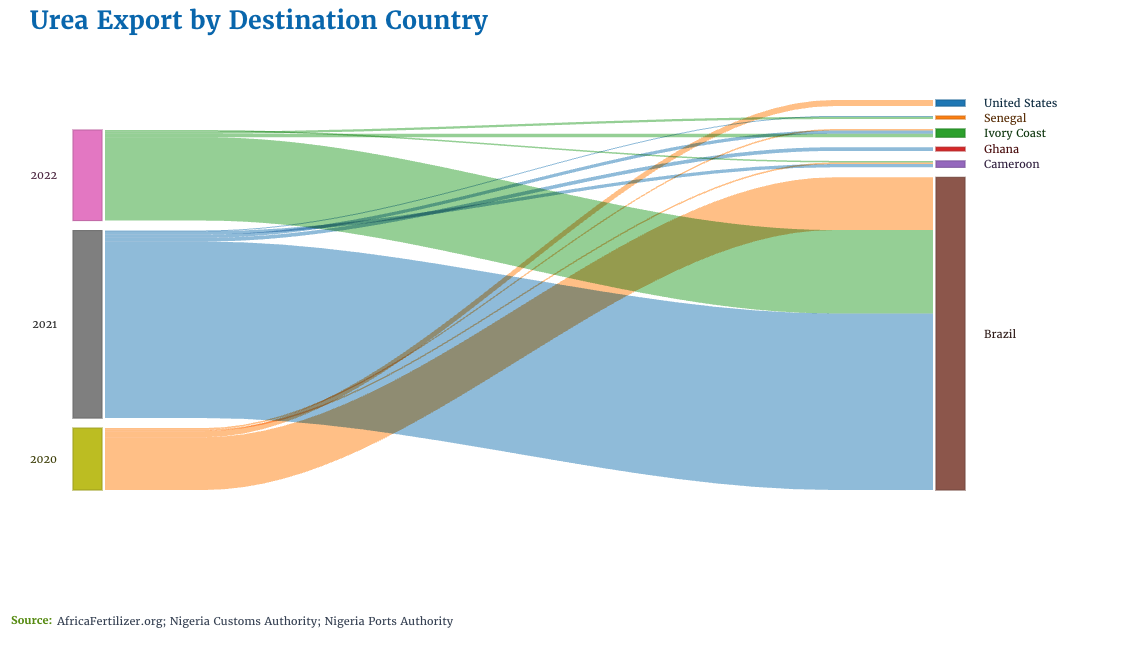

But the market in Nigeria is changing. Throughout the past decade, the government ceased announcing fertilizer tenders. During this period, the private sector invested in large-scale urea nitrogen plants in the country (urea is a nitrogen-based product which is one of the three key nutrients — phosphorus and potassium being the other two — needed for plant growth). This has transitioned Nigeria from being a net importer of nitrogen-based fertilizers to becoming a net exporter.

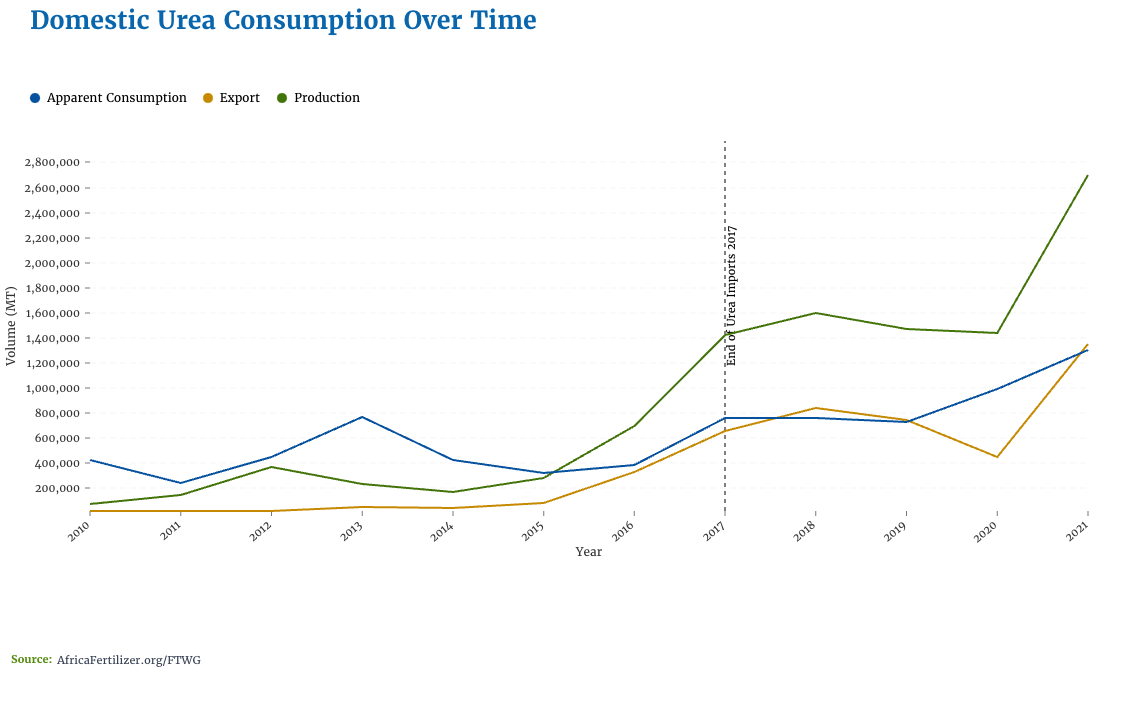

Domestic urea plant capacity has grown from approximately 500,000 MT per annum to current capacity of over 6,000,000 MT per annum. In the past, fertilizer consumption would spike around the national election cycle as the supply would be tied to government issued tenders. Since 2016, nitrogen consumption has realized a consistent increase in domestic consumption peaking at 1,303,423 in 2021 as shown in the chart below.

Recent Timeline of Nigeria's Fertilizer Sector

As the timeline highlights, the roles of the private sector and the public sector are shifting. Since the 1960s and through recent times, the government has been heavily involved in the supply of fertilizer to farmers through tenders, subsidies, and importations. During this time, the private sector was often considered a middle-man that did not add value in the supply chain.

Challenges that stemmed from the reliance on government-managed tenders are now changing. Since 2014, Nigeria has become a net exporter and global powerhouse in the production of urea. With the private sector investing in the natural gas reserves to produce urea, the role of the public sector and the private sector is transitioning to a more efficient marketplace that better addresses the needs of Nigeria’s farmers. In regards to urea, Nigeria’s farmers are no longer burdened with the constraints around availability and accessibility and domestic urea consumption has continued to increase since 2015.

Long-term investments in urea have for the first time created matching incentives between private sector, public sector, and the farmer. According to Nigeria’s Fertilizer Technical Working Group, private-sector domestic sales of urea have a higher return on investment compared to exports. Thus, substantial investments are taking place in the supply chain to strengthen farmer access and product availability. For the Nigerian farmers, this means one of the primary fertilizer products — urea with 46% nitrogen — is now readily available throughout the country.

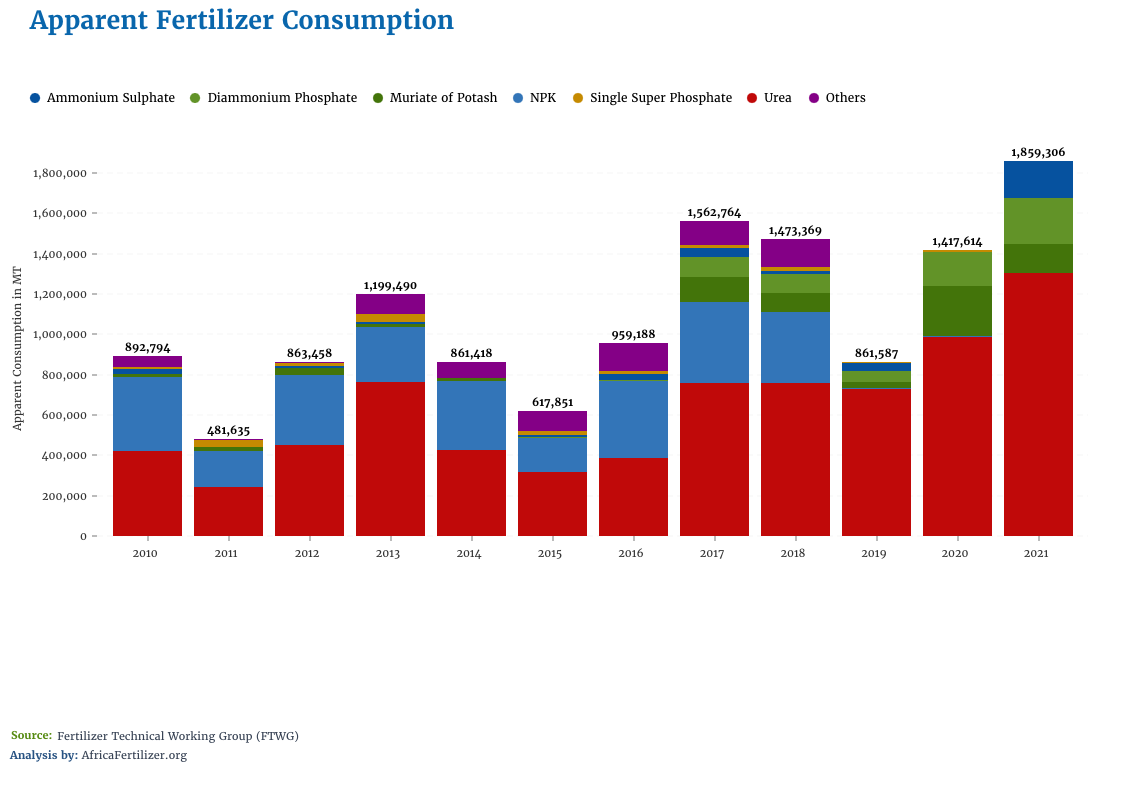

The sudden change in the availability of domestic urea also created an incentive for private-sector entrepreneurs to invest in domestic NPK blending plants and further drove the Federal Government of Nigeria to encourage utilization of this nitrogen product to support domestic NPK production through the Presidential Fertilizer Initiative. However, rapid growth in domestic NPK production presents new challenges and obstacles to overcome for the public sector, private sector, farmers, and other key stakeholders. There is a dire need to understand what these obstacles are and how to take advantage of this new and dynamic market.

This is where DG, IFDC, and our partners come in. The Visualizing Insights on Fertilizer for African Agriculture (VIFAA) program is bringing together needed data from a variety of actors in the public and private fertilizer sector with the goal of understanding how to use this data to make informed decisions. This includes supporting future investments by the private sector and addressing policies and regulations by the public sector to ensure that fertilizer products are able to improve soil nutrients, farmer profitability, and ultimately to support an increase in agricultural productivity.

In 2021, VIFAA launched the Nigeria fertilizer dashboard to support the nation’s agriculture sector. This dashboard features 14 indicators including price, availability, and a plant directory. In 2021 and 2022, VIFAA and their partners have also invested in new technologies to develop cropland under production maps using geo-spatial mapping and artificial intelligence to build a better understanding of changes in cropping patterns.

Stay tuned for future blogs about Nigeria’s changing market.

Cover photo by Markus Winkler on Unsplash

VIFAA Going Forward

In November 2022, AfricaFertilizer (AFO), our partner on the Visualizing Insights on Fertilizer for African Agriculture (VIFAA) program, rebranded and launched a new website. This website includes the integration of country-specific VIFAA dashboards, which were previously housed in separate websites. By integrating the country-specific dashboards as well as fertilizer data on trade, production, consumption, and retail prices for 18 countries in sub-Saharan Africa, the new AFO data allows easier comparative analysis across countries and contributes its quota to the advancement of food security throughout Africa.

We have updated the previous country-specific dashboards links to now redirect you to AFO’s new website in order to ensure you are accessing the most up-to-date resources.

Share

Recent Posts

Preparing Jordan’s Education System for the AI Age

This blog introduces Asas, an early grade education program led by IREX and DG in partnership with Jordan’s Ministry of Education, and explores what AI readiness looks like in early grades and how AI can be integrated safely and sustainably into education systems.

Beyond the Algorithm: The Case for Human Judgment in AI

As AI spreads across sectors, this blog explores why human-in-the-loop approaches remain essential, examining how human judgment supports ethical and sustainable AI, the limits of this approach, and what comes next.

Data on Youth and Tobacco in Africa Program Enters Phase II

The Data on Youth and Tobacco in Africa (DaYTA) program is launching its second phase, expanding to five additional countries. This blog highlights DaYTA’s objectives, innovative approach, and the key activities driving impact in adolescent tobacco control measures.