New Crisis Monitoring Tool Provides Insight into Sub-Saharan Africa’s Fertilizer Sector

Background

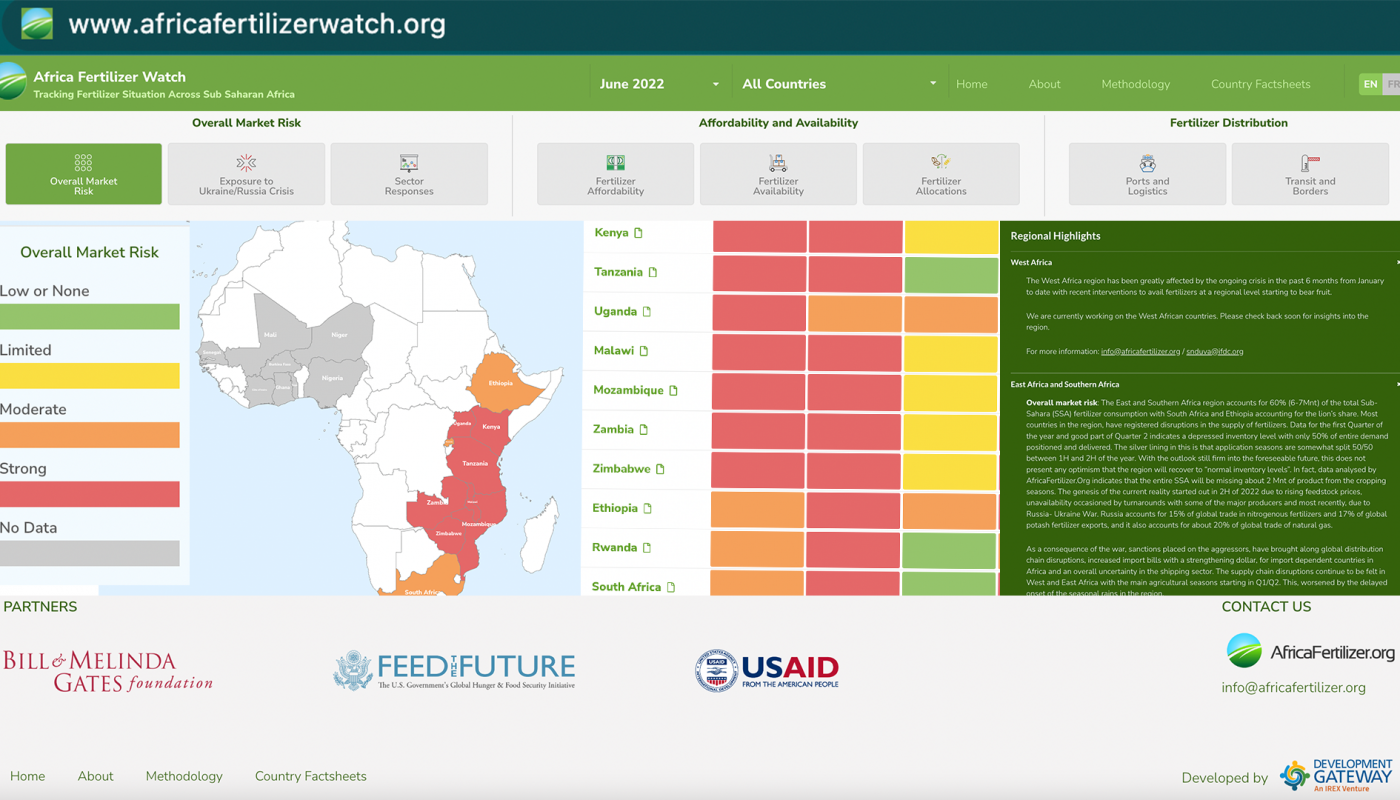

On July 24, Development Gateway: an IREX Venture (DG), the International Fertilizer Development Center (IFDC), and AfricaFertilizer.org (AFO) released an update to the Africa Fertilizer Watch Dashboard, a project which grew out of the AFO and DG’s Visualizing Insights on Fertilizer for African Agriculture (VIFAA) program. The VIFAA Program aims to improve, manage, and visualize fertilizer data in Africa. The Africa Fertilizer Watch Dashboard was originally developed to track COVID-19’s impact on the fertilizer sector. The Dashboard has been updated to cover ten countries in Eastern and Southern Africa and includes added indicators designed to track the impact of the invasion of Ukraine on the delivery and use of fertilizers across the continent. The Africa Fertilizer Watch supports efficient and effective responses to the evolving food and fertilizer crises and ensures that sufficient quantities of appropriate fertilizers reach farmers in time for planting.

Currently, sub-Saharan Africa (SSA) has the lowest fertilizer usage in the world; it is insufficient to replace the soil nutrients lost every year to crop production. In addition, huge demographic shifts in SSA could have a major impact on food security. Understanding where and how barriers to fertilizer access and availability are affecting farmers is crucial for agricultural productivity.

The Africa Fertilizer Watch was developed through a partnership between IFDC’s AFO initiative and Development Gateway. It is jointly funded by the U.S. Agency for International Development (USAID) Bureau for Resilience and Food Security, through the Feed the Future Soil Fertility Technology Adoption, Policy Reform, and Knowledge Management under the Sustainable Opportunities for Improving Livelihoods with Soils (SOILS) Consortium, and the Bill & Melinda Gates Foundation, through the Visualizing Insights on Fertilizer for African Agriculture (VIFAA) program. Other technical partners include the African Fertilizer and Agribusiness Partnership (AFAP) and AFRIQOM.

Russia is the world’s largest exporter of fertilizers. Given that the continent of Africa relies on Russia for some of its fertilizer needs, the Africa Fertilizer Watch monitors the impact of the Russian invasion of Ukraine on fertilizer market systems in SSA. Other key indicators are related to the affordability and availability of fertilizer within the SSA region.

Africa Fertilizer Watch: Tracking the Fertilizer Situation Across Sub-Saharan Africa

The Africa Fertilizer Watch is publicly available online and monitors eight indicators: overall fertilizer market risk with regard to stock levels and supply anomalies, availability, affordability, and distribution measures to track and visualize the invasion of Ukraine’s impact on access and use of fertilizers across Africa. It also monitors:

- how countries are allocating fertilizer, whether for food production or otherwise, in light of the global fertilizer crisis

- countries monthly inventory level

- government responses to the ongoing crisis

- and fertilizer-specific measures and/or logistical issues affecting the movement of fertilizers from ports to farms (ports, roads, borders, retail, stocks, and sector-wide responses).

Data on the war in Ukraine is obtained from various public press releases. Overviews of market risk, affordability/availability, and distribution bottlenecks are informed by direct communications from fertilizer stakeholders and regional fertilizer associations, government agencies, local media, and other relevant trackers. The Africa Fertilizer Watch data is periodically updated as needed or as new information is available. More information about the methodology can be found on the Africa Fertilizer Watch website.

Project Partners

International Fertilizer Development Center (IFDC) – As an independent non-profit organization, IFDC works throughout Africa and Asia to increase soil fertility and develop inclusive market systems. Combining science-backed innovations, an enabling policy environment, holistic market systems development, and strategic partnerships, the organization bridges the gap between identifying and scaling sustainable agricultural solutions, resulting in improved household food security and enriched family livelihoods around the world. Using an inclusive approach, IFDC employs locally driven solutions that are environmentally sound and impact oriented that bring change at local, regional, and national levels.

Sustainable Opportunities for Improving Livelihoods with Soils (SOILS) Consortium – IFDC has implemented the USAID-funded Bureau for Resilience and Food Security Feed the Future Sustainable Opportunities for Improving Livelihoods with Soils (SOILS) Consortium (BRFS-SFT-SOILS) program since 2015. The project bridges the gap between scientific research and technology dissemination to smallholder farmers. BRFS-SFT conducts research with partners from universities, national and international research and development institutions, and the private sector. The overall goal of SOILS is to offer practical, profitable, scale-appropriate soil, and land-use management technologies and recommendations for healthier and productive farming systems globally. SOILS priority areas include developing and transferring soil fertility technologies that improve nutrient use efficiency, in alignment with the 4Rs of Nutrient Stewardship: right source, right time, right rate, and right place. This is achieved by strengthening inorganic fertilizer-based systems and promoting integrated soil health and fertility management practices for optimal economic returns, focusing on smallholder cropping systems.

AfricaFertilizer.org (AFO) – the premier source for fertilizer statistics and information in Africa. It is hosted by IFDC and supported by several partners, key among them being the International Fertilizer Association (IFA), Argus Media, and the Bill & Melinda Gates foundation through Development Gateway under the VIFAA program. Since 2009, AFO has been collecting, processing, and publishing fertilizer production, trade, and consumption statistics for the main fertilizer markets in sub-Saharan Africa. AFO has an extensive network of fertilizer industry players in the main fertilizer trade corridors and maintains key information on the major producers, their production facilities and capacities, importers/suppliers, and various distribution channels.

African Fertilizer and Agribusiness Partnership (AFAP) – an independent non-profit organization founded in 2012 by a partnership of African development organizations. It was built on the work of the Comprehensive Africa Agriculture Development Programme (CAADP), a framework for achieving ambitious agriculture development goals set by African nations and leaders. AFAP implements sustainable development projects and advises the public sector, private sector clients, non-governmental organizations (NGOs), and donors on policies and market-driven business solutions in the agriculture inputs and agribusiness value chain. AFAP is a technical partner of the Africa Fertilizer Watch.

AFRIQOM – an independent privately held firm that provides market research, analytics, trading intelligence, and consultancy studies, with a focus on African fertilizer markets. By doing so, and being the leaders on the continent, AFRIQOM brings transparency to an opaque market to help and contribute to an Africa Green Revolution. AFRIQOM has recently launched the AFRIQEVENTS program, in partnership with major associations, for conferences around the continent that offer a novel platform to develop the fertilizer consumption rate in Africa.

This blog is a press release jointly written with IFDC and AFO.

VIFAA Going Forward

In November 2022, AfricaFertilizer (AFO), our partner on the Visualizing Insights on Fertilizer for African Agriculture (VIFAA) program, rebranded and launched a new website. This website includes the integration of country-specific VIFAA dashboards, which were previously housed in separate websites. By integrating the country-specific dashboards as well as fertilizer data on trade, production, consumption, and retail prices for 18 countries in sub-Saharan Africa, the new AFO data allows easier comparative analysis across countries and contributes its quota to the advancement of food security throughout Africa.

We have updated the previous country-specific dashboards links to now redirect you to AFO’s new website in order to ensure you are accessing the most up-to-date resources.

Share

Related Posts

From Data Gaps to Impact: Key Insights from the VIFAA Program

Over the last six years, DG, together with its partners AfricaFertilizer (AFO) and Wallace & Associates, collaborated to implement the Visualizing Insights on Fertilizer for African Agriculture (VIFAA) Program. In the program’s final year (2024), the team undertook a “program learning process” to reflect on outcomes, challenges, and successes through internal interviews. This blog captures five key learnings, which we hope will guide similar programs aiming to bridge data gaps in agricultural development.

Case Study: Fostering Sustainable Agriculture through Data-Driven Collaboration and Partnership: Ethiopia, Mozambique, and Nigeria

Through DG’s Visualizing Insights on Fertilizer for African Agriculture (VIFAA) program, we recently published a case study titled “Fostering Sustainable Agriculture through Data-Driven Collaboration and Partnership: Ethiopia, Mozambique, and Nigeria.” It dives deep into how the VIFAA program has impacted the fertilizer data and markets in Ethiopia, Mozambique, and Nigeria. In this blog, we explore the overall impact that the VIFAA program is making, why the program was needed, and offer some key highlights from the case study.

Fertilizer Technical Working Groups Provide Key Insights into Africa’s Fertilizer Sector

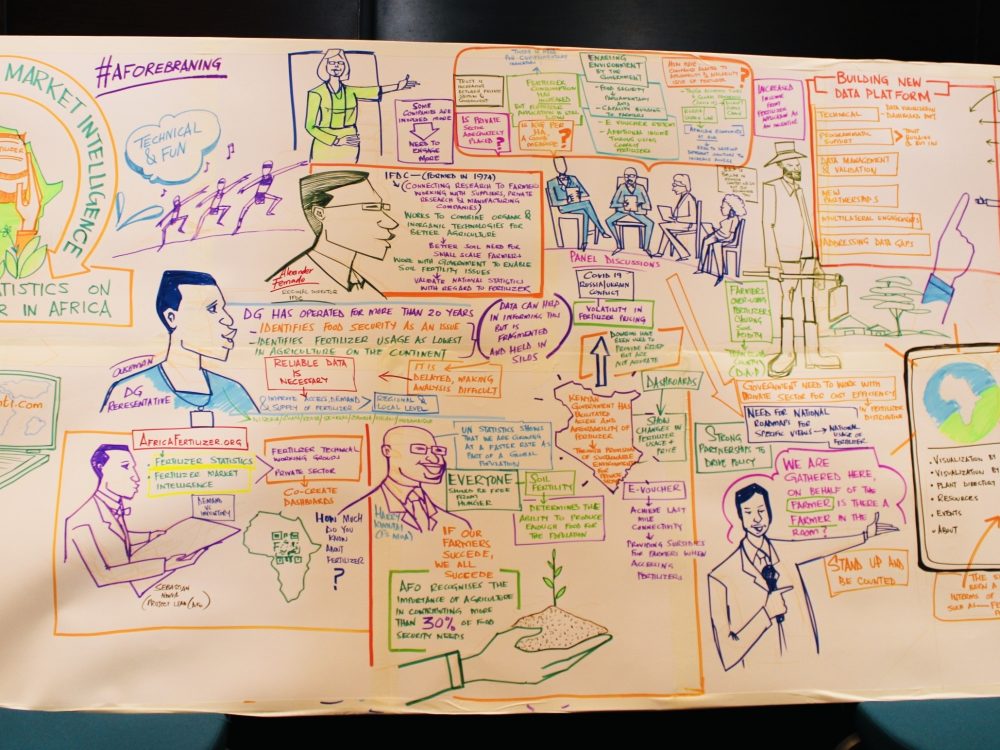

From June 2021 to September 2022, Development Gateway: An IREX Venture’s (DG’s) Visualizing Insights on Fertilizer for African Agriculture (VIFAA) program convened 12 Fertilizer Technical Working Groups in 14 countries which have yielded essential information on Africa’s fertilizer sector, including insights on how geopolitical events have impacted the fertilizer sector and what is needed to mitigate resulting threats to food security throughout Africa.