Nigeria’s Changing NPK Market (Part 2)

As highlighted in Part 1, the nitrogen story in Nigeria is quite impressive. However, crops cannot grow on nitrogen alone. Seventeen nutrients are required for plant growth, with nitrogen (N), phosphorus (P), and potassium (K) serving as the essential trio (NPK). Private sector urea investments have encouraged entrepreneurs to invest in domestic NPK blending plants. Typically, companies that operate fertilizer blending plants produce specific blends made from all three of these essential nutrients, and often blends are created with other micronutrients that address specific needs for a plant’s nutrient uptake.

Moving Away from the “One Size Fits All” Model

Prior to this recent upsurge in investments in the fertilizer sector, Nigeria imported NPK products, and these imports would compete with domestic blending plant operators. The majority of these domestic plants were either owned by state governments or relied on government contracts to operate. Product quality was a concern by the farming community because many of these operators considered the government as their customer rather than the farmer. This remains an area of concern during this transition from imported to domestic NPK production, as local blending plants do not clear their final product through customs or the port before selling it to the farmer.

For more than 20 years, Nigeria’s primary NPK products consisted of common N, P, and K blends – usually 15 15 15 (equal parts N, P, and K) or 20 10 10 (double the amount of N to the amount P and K). These fertilizer types were generic enough to be applied to all crops but most closely aligned with nutrient requirements for maize. This “one size fits all” approach was primarily due to economies of scale, as importers and government tenders supported a “one-size-fits-all” approach.

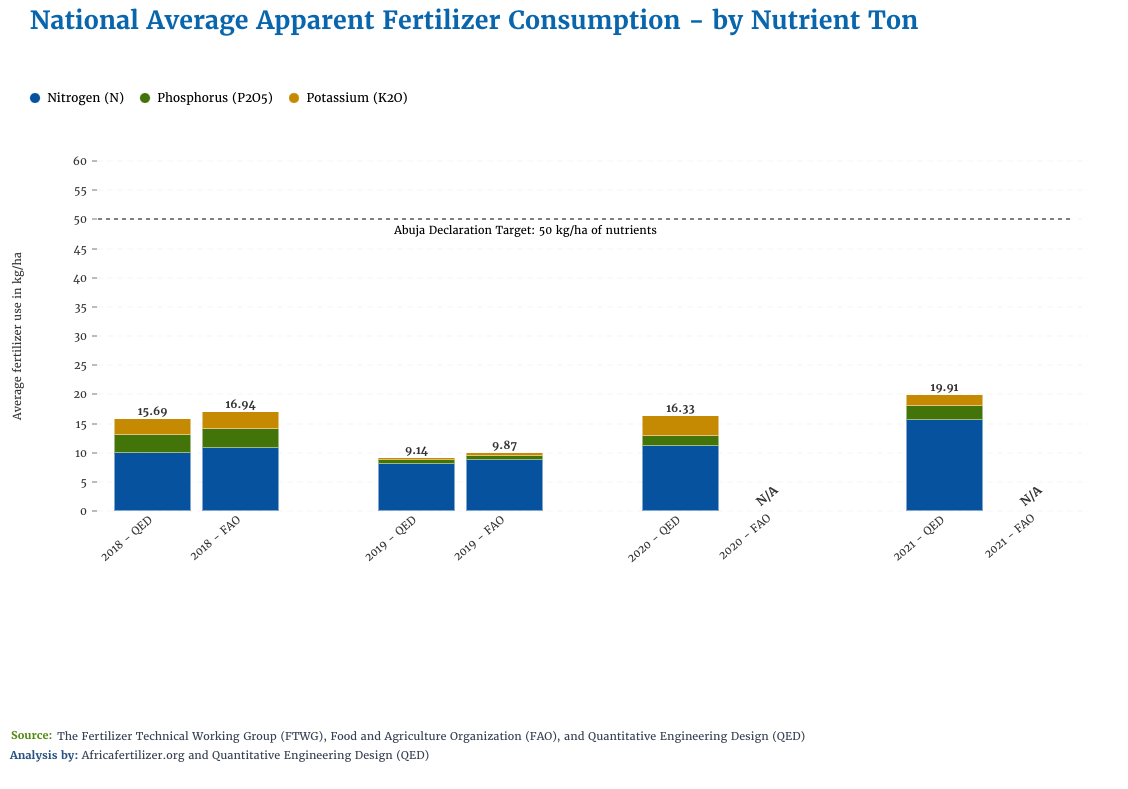

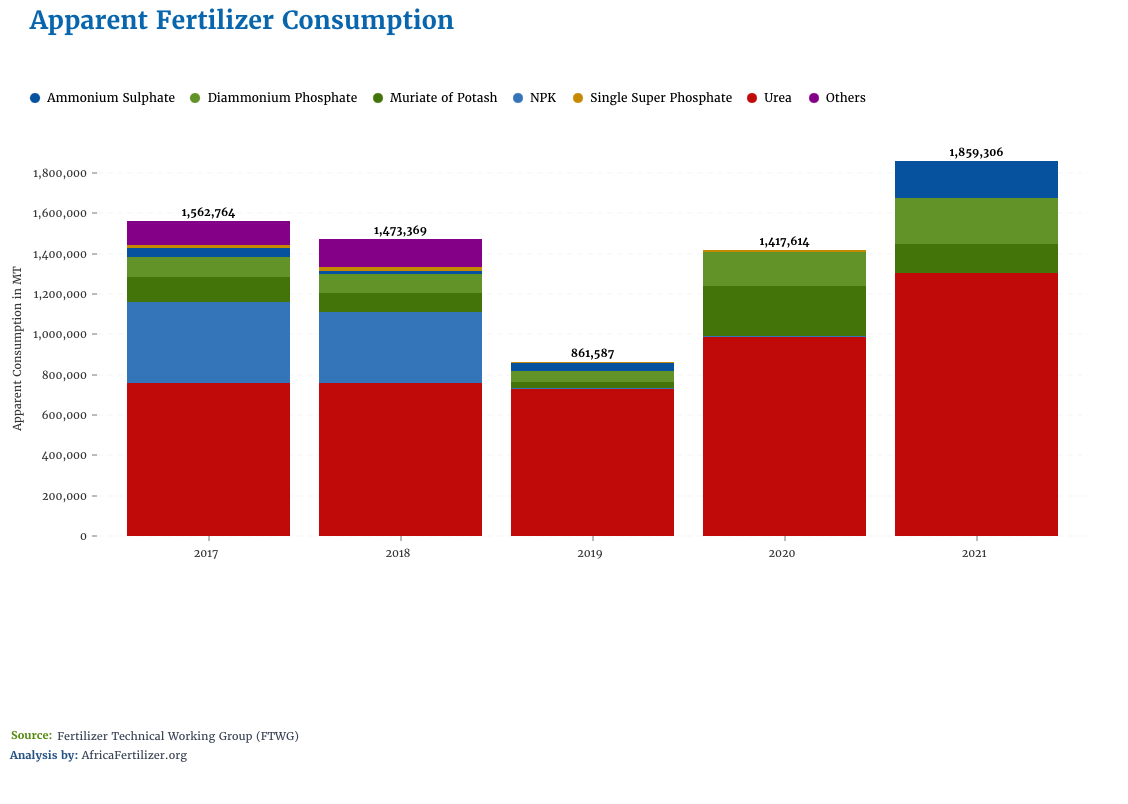

Changes in the nitrogen production have increased the use of nitrogen-based fertilizers. And the use of fertilizer has nearly doubled since 2015 (most of it led by the increased use of nitrogen-based fertilizers, such as urea).

Becoming a Nitrogen-Fertilizer Market Leader

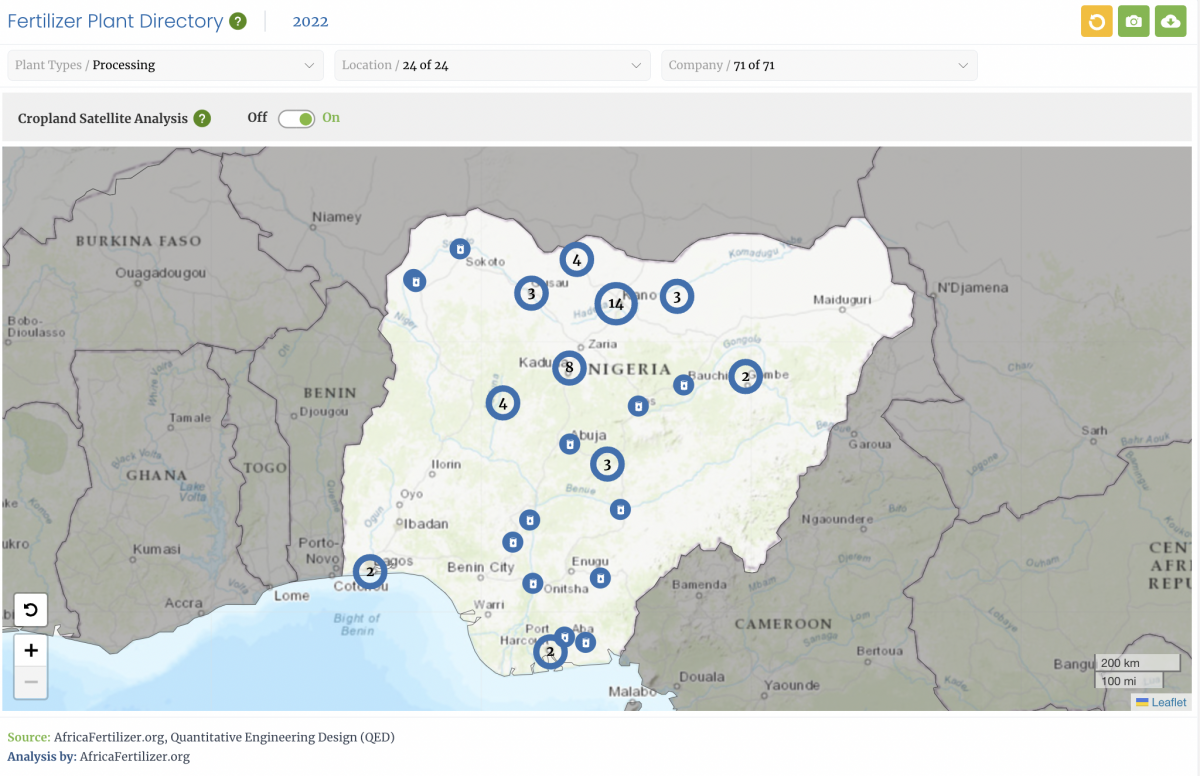

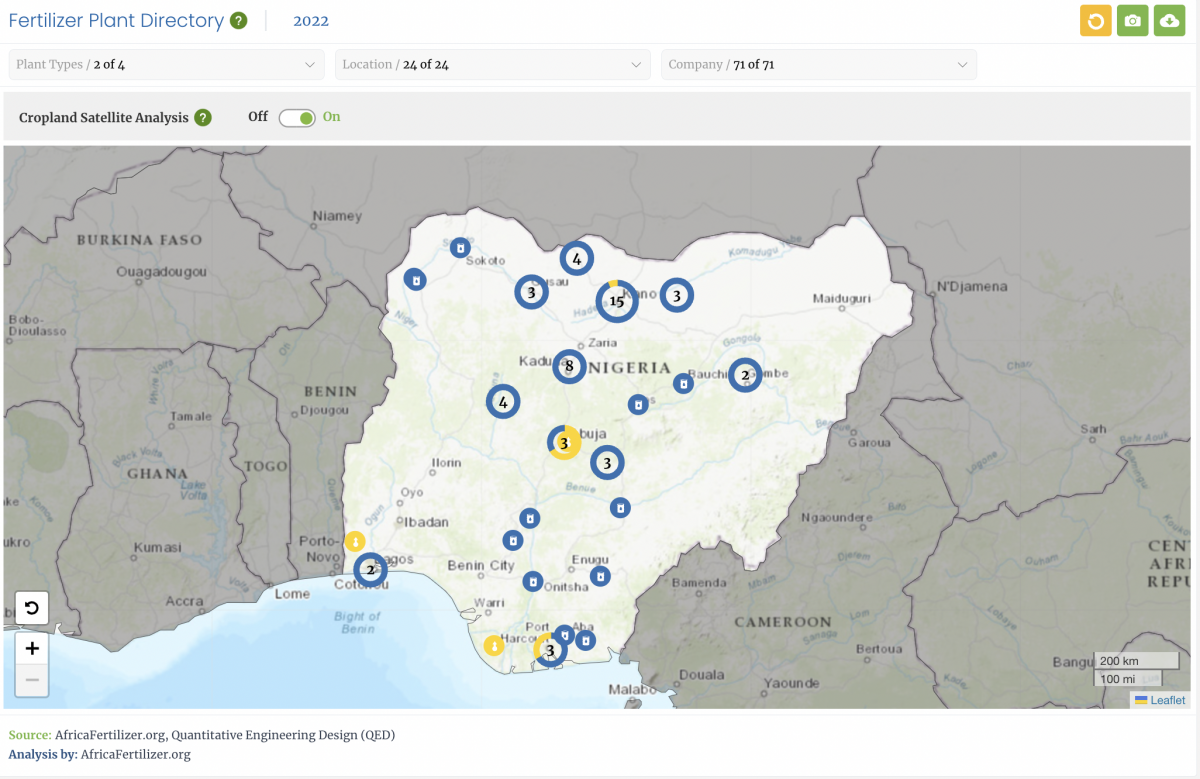

However, the change in the nitrogen market has given rise to a new market for private sector actors. Once Nigeria became a global supplier of nitrogen-based fertilizer, it no longer made economic sense for NPK products to be imported when domestic nitrogen could be used in-country. Currently, more than 75 blending plants exist in Nigeria, 18 of which have come online since 2015.

In 2016, the Presidential Fertilizer Initiative (PFI) was created between President Muhammadu Buhari and the King of Morocco to supply discounted phosphate for NPK blends within Nigeria which further encouraged the growth of blending plants. In November 2018, the Central Bank of Nigeria banned the use of foreign exchange for imports of NPK fertilizers in an effort to bolster domestic production.1 2 This explains the explosive growth of blending plants within Nigeria over the past few years.

As phosphorus and potassium are not domestically available, these blending plants use domestic urea (46% nitrogen) combined with other imported raw materials such as diammonium phosphate or DAP (18% nitrogen and 46% phosphorous) alongside muriate of potassium or MOP (60% potassium) to create NPK blends.

As evidenced by the apparent consumption chart below, P and K consumption has not kept pace with the domestically produced nitrogen (urea) consumption.

The rapid growth of blending plants now creates an opportunity that can have a transformative impact on the country’s agriculture sector. A key benefit of domestic blending plants is the flexibility to supply the specific nutrient needs for the crops grown in the locality. For example, a tomato fertilizer blend in Plateau State could equate to 8-32-16 whereas a cassava blend in Nasarawa State could be 6-14-32 and a 20-5-5 blend for rice farmers in Sokoto. Even though the NPK formulas presented above are meant for illustrative purposes, one can distinguish the variation in nutrient needs by crop. Historically, this attention to crop and soil nutrient needs was not possible when NPK was imported in 10 to 15,000 MT increments.

Why Use a Dashboard to Improve Crop Yields?

The nutrients available within the soil can vary between geographic areas. Every time a farmer harvests a crop and takes the product out of the field, they are taking nutrients from the soil. Crop yields improve when farmers can access and use fertilizers with specific ratios of N, P, and K to supplement the soil’s existing nutritional profile. The Visualizing Insights on Fertilizer for African Agriculture (VIFAA) program provides an opportunity for blending plants to access critical data needed to make crop-specific or site-specific NPK blends a reality.

The government’s role is also starting to change, going from ensuring fertilizer products are available to ensuring product quality and supporting new blends. The government can enable products that maximize farmer yield by providing education on blends, supporting programs to encourage new NPK products from the private sector, and supporting soil mapping technology. As blending plant growth has exploded in Nigeria, the government needs to monitor this growth to ensure that soil health is protected and crop yield is sustained. Policy changes to support the market are vital to ensuring its sustainability.

The VIFAA Dashboards are an important part of ensuring all stakeholders in the supply chain have access to the information they need, which ultimately ensures that farmers have the best fertilizer available in time for planting.

VIFAA Going Forward

In November 2022, AfricaFertilizer (AFO), our partner on the Visualizing Insights on Fertilizer for African Agriculture (VIFAA) program, rebranded and launched a new website. This website includes the integration of country-specific VIFAA dashboards, which were previously housed in separate websites. By integrating the country-specific dashboards as well as fertilizer data on trade, production, consumption, and retail prices for 18 countries in sub-Saharan Africa, the new AFO data allows easier comparative analysis across countries and contributes its quota to the advancement of food security throughout Africa.

We have updated the previous country-specific dashboards links to now redirect you to AFO’s new website in order to ensure you are accessing the most up-to-date resources.

Share

Recent Posts

Beyond Kigali: Where Does Africa Go from Here with AI?

As governments, funders, entrepreneurs, and technology leaders rally around the AI moment and move towards actions, at Development Gateway, we are asking a different set of questions: Where is the data, and what is the quality of the data behind the algorithms? How will legacy government systems feed AI tools with fresh and usable data? Are Government ministries resourced to govern and trust the AI tools that they are being encouraged to adopt?

Shared Struggles, Shared Solutions: Education and Cross-Sector Data Use Insights

This blog draws on DG’s experience in climate, health, aid management, and agriculture to explore connections between the challenges of data collection, data hosting, and data governance across different sectors and what the solutions to overcoming them can teach us about strengthening education data systems.

Economic Toll of Tobacco-Related Diseases in Kenya: New Research Findings

Development Gateway: An IREX Venture (DG) is pleased to announce the publication of a research manuscript on the Economic Costs of Tobacco-Related Illnesses in Kenya. This research was carried out as part of the Tobacco Control Data Initiative (TCDI) activities in Kenya and is part of a broader report on Morbidity and Mortality from Tobacco Use in Kenya.