Voices of the Cashew Sector – Kassimou Issaka

Since 2020, Development Gateway: an IREX Venture (DG) has partnered with Cultivating New Frontiers in Agriculture (CNFA) under the USDA West Africa PRO-Cashew project to develop the Cashew-IN data collection and analysis platform.

The project has identified gaps in the data collection, storage, usage, and dissemination related to the cashew sector in all five of the implementing countries (Benin, Burkina Faso, Côte d’Ivoire, Ghana, and Nigeria). The project is now working to address these gaps through a multi-country cashew data management system (Cashew-IN) that will facilitate access to and use of data to improve decision-making for policymakers, farmers, and the private sector. The ultimate goal is to generate better market outcomes for cashew nuts in these countries.

Kassimou Issaka, Agroeconomist and General Manager of the Territorial Agency for Agricultural Development (ATDA Pôles), gives an overview of ATDA Pôles’ work and explains how the Cashew-IN platform developed by CNFA and DG will support his work.

In a few words, what’s the ATDA Pôles?

The Territorial Agency for Agricultural Development is an organization under the Ministry of Agriculture, Livestock and Fisheries (MAEP) of Benin whose mission is to implement the government’s policy on the promotion of promising sectors specific to the Borgou Sud – Donga – Collines of Benin. It has a legal status and financial autonomy and groups together sixteen communes with its headquarters in Parakou.

The ATDA4’s responsibilities include developing, validating, and conducting plans with key actors in the cluster’s territory; facilitating access to information and innovations for stakeholders in the sectors; coordinating agricultural sector development projects in the cluster; and coordinating the interventions of public and private actors in the agricultural sectors in the development cluster.

What is your ambition for the cashew sector in Benin throughout the next five years?

From 2019-2021, Benin aimed to increase the production of raw cashew nuts to 300,000 tons and process 50% (i.e., 150,000 tons) locally. Currently, the evaluation of the achievement of this ambition is underway. However, it can already be noted that the target production has not been reached and the processing units installed have a capacity that is much lower than expected.

From 2021, the Government of Benin launched the feasibility study of the National Program for the Development of Plantations and Major Crops (PNDPGC). The cashew nut sector figures prominently in this program. Indeed, Benin plans to install 500,000 ha of new cashew plantations within five years and to process locally all of its production. To achieve this, processing units and a decree have been issued by the Government to prohibit the export of raw cashew nuts from Benin as of April 1, 2024.

How can the Cashew-IN tool help you achieve your objectives?

With the Cashew-IN platform, potential areas for production expansion can be identified in Benin. The same applies to facilitating the monitoring of the evolution of the sector’s indicators. The information will support proper decision-making.

This interview was edited for clarity and style.

For any questions or comments, please reach out to Constance Konan at ckonan@developmentgateway.org.

Partners

USDA

The U.S. Department of Agriculture is a federal department that provides leadership on food, agriculture, natural resources, rural development, nutrition, and related issues based on public policy, the best available science, and effective management. Through their PRO-Cashew project, USDA is working to boost the competitiveness of West African producers by improving efficiency and quality in production and trade, and by working to develop more coherent regional trade and investment policies.

CNFA

Cultivating New Frontiers in Agriculture is an international agricultural development organization that specializes in the design and implementation of sustainable, enterprise-based agricultural initiatives. We work with businesses, foundations, governments, and communities to build customized local and global partnerships that meet the world’s growing demand for food. Since its inception in 1985, CNFA has designed and implemented enterprise-based, agricultural development initiatives to facilitate market access, enhance agribusiness competitiveness, increase productivity, and improve access to inputs and financing in 47 countries around the world.

To learn more about Cashew-IN, check out our Cashew-IN program playlist on YouTube.

Share

Recent Posts

Supporting Ethiopia’s National Soil Fertility and Health Action Plan

Declining soil fertility remains a major constraint on Ethiopia’s agricultural productivity. This blog reflects on the launch of the National Soil Fertility and Health Roadmap and DG’s support in its development, highlighting lessons on government-led reform and long-term resilience.

Development Gateway Collaborates with 50×2030 Initiative on Data Use in Agriculture

Development Gateway announces the launch of the Data Interoperability and Governance program to collaborate with the 50x2030 initiative on data use in agriculture in Senegal for evidence-based policymaking.

Strengthening Online Safety Through Prevention in the Philippines

Tech-Facilitated Gender-Based Violence continues to evolve alongside emerging technologies. This blog explores how preventative measures, such as the Safety By Design approach, can be used to create a safer internet.

Nigeria’s Changing Fertilizer Sector (Part 1)

In the past decade, there has been over $7 billion worth of private-sector investments into Nigeria’s agriculture sector. Why, and what is the impact of these investments? What does it mean for Nigerian farmers? Just under 95% of those investments came from the fertilizer sector ($6.6 billion). Historically, fertilizer was considered the government’s turf where the Ministry of Agriculture was the buyer (through tenders or contracted suppliers), and the state governments were the primary customer. Thus, in most cases the private sector did not have a strong connection to the smallholder farmer and fertilizer was typically a scarce commodity when the rains began to fall.

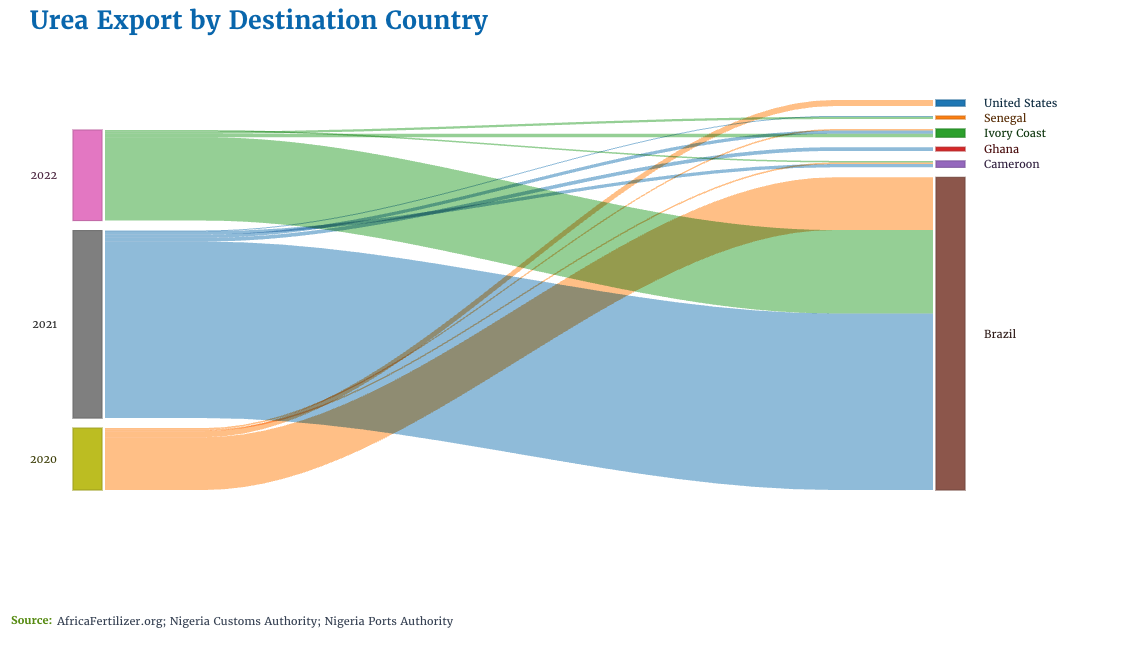

But the market in Nigeria is changing. Throughout the past decade, the government ceased announcing fertilizer tenders. During this period, the private sector invested in large-scale urea nitrogen plants in the country (urea is a nitrogen-based product which is one of the three key nutrients — phosphorus and potassium being the other two — needed for plant growth). This has transitioned Nigeria from being a net importer of nitrogen-based fertilizers to becoming a net exporter.

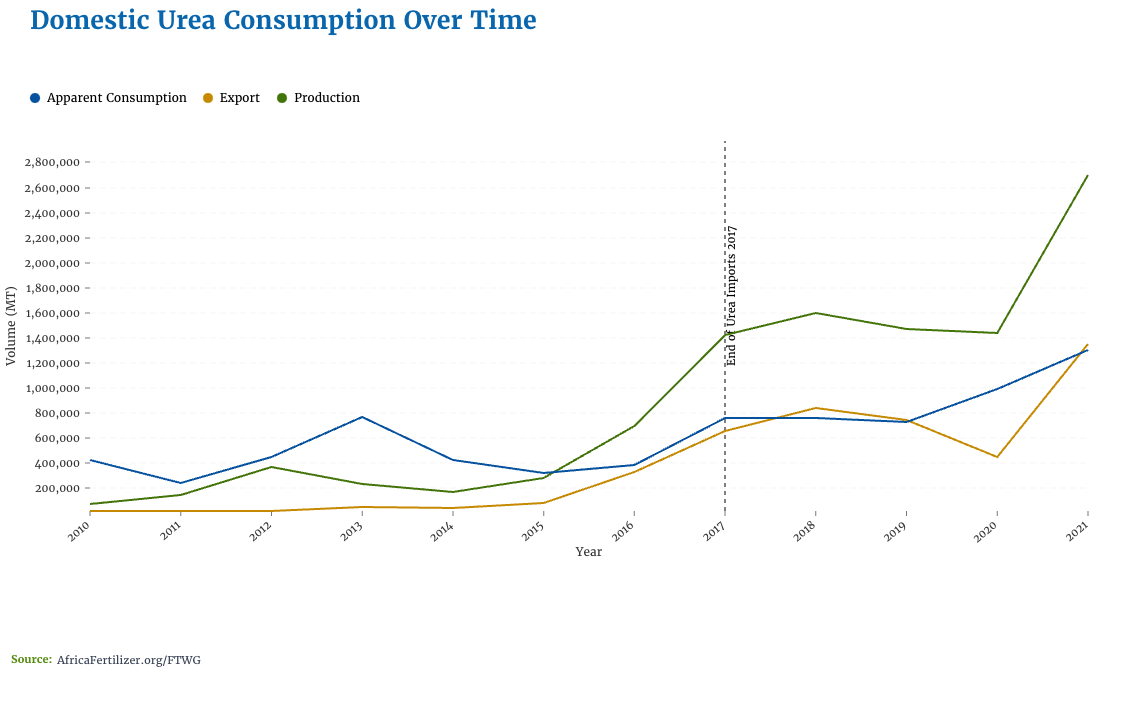

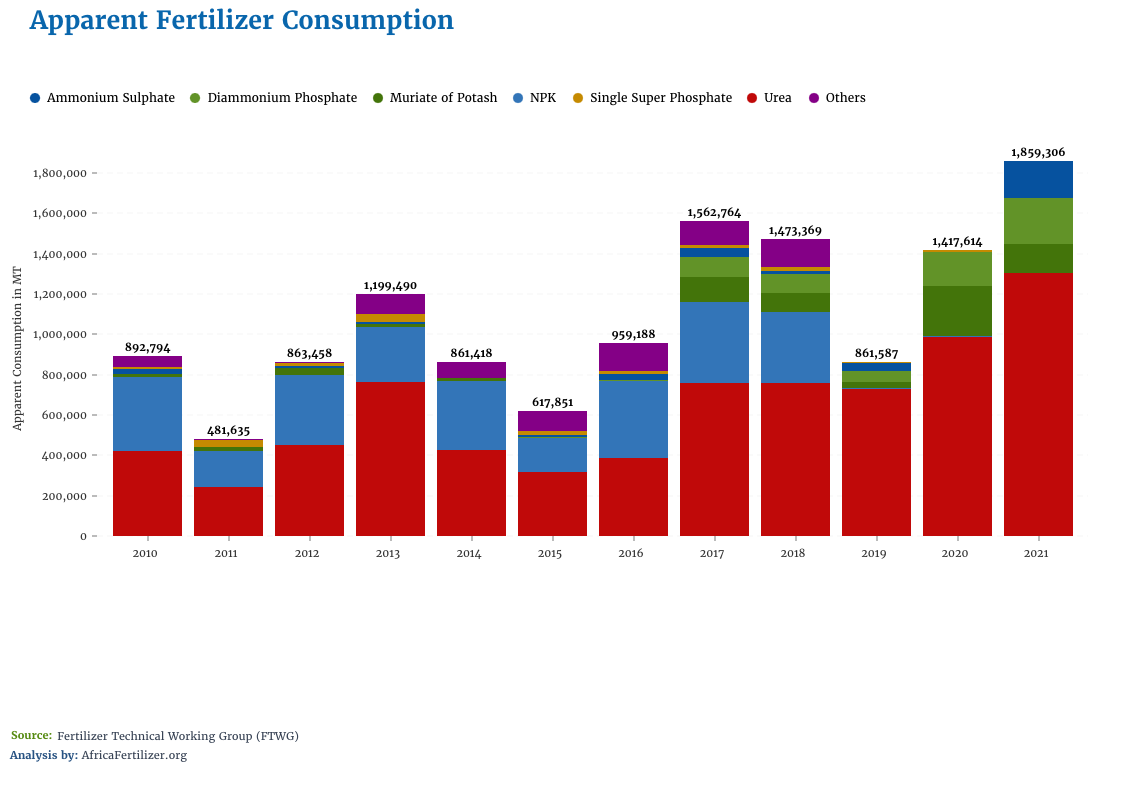

Domestic urea plant capacity has grown from approximately 500,000 MT per annum to current capacity of over 6,000,000 MT per annum. In the past, fertilizer consumption would spike around the national election cycle as the supply would be tied to government issued tenders. Since 2016, nitrogen consumption has realized a consistent increase in domestic consumption peaking at 1,303,423 in 2021 as shown in the chart below.

Recent Timeline of Nigeria's Fertilizer Sector

As the timeline highlights, the roles of the private sector and the public sector are shifting. Since the 1960s and through recent times, the government has been heavily involved in the supply of fertilizer to farmers through tenders, subsidies, and importations. During this time, the private sector was often considered a middle-man that did not add value in the supply chain.

Challenges that stemmed from the reliance on government-managed tenders are now changing. Since 2014, Nigeria has become a net exporter and global powerhouse in the production of urea. With the private sector investing in the natural gas reserves to produce urea, the role of the public sector and the private sector is transitioning to a more efficient marketplace that better addresses the needs of Nigeria’s farmers. In regards to urea, Nigeria’s farmers are no longer burdened with the constraints around availability and accessibility and domestic urea consumption has continued to increase since 2015.

Long-term investments in urea have for the first time created matching incentives between private sector, public sector, and the farmer. According to Nigeria’s Fertilizer Technical Working Group, private-sector domestic sales of urea have a higher return on investment compared to exports. Thus, substantial investments are taking place in the supply chain to strengthen farmer access and product availability. For the Nigerian farmers, this means one of the primary fertilizer products — urea with 46% nitrogen — is now readily available throughout the country.

The sudden change in the availability of domestic urea also created an incentive for private-sector entrepreneurs to invest in domestic NPK blending plants and further drove the Federal Government of Nigeria to encourage utilization of this nitrogen product to support domestic NPK production through the Presidential Fertilizer Initiative. However, rapid growth in domestic NPK production presents new challenges and obstacles to overcome for the public sector, private sector, farmers, and other key stakeholders. There is a dire need to understand what these obstacles are and how to take advantage of this new and dynamic market.

This is where DG, IFDC, and our partners come in. The Visualizing Insights on Fertilizer for African Agriculture (VIFAA) program is bringing together needed data from a variety of actors in the public and private fertilizer sector with the goal of understanding how to use this data to make informed decisions. This includes supporting future investments by the private sector and addressing policies and regulations by the public sector to ensure that fertilizer products are able to improve soil nutrients, farmer profitability, and ultimately to support an increase in agricultural productivity.

In 2021, VIFAA launched the Nigeria fertilizer dashboard to support the nation’s agriculture sector. This dashboard features 14 indicators including price, availability, and a plant directory. In 2021 and 2022, VIFAA and their partners have also invested in new technologies to develop cropland under production maps using geo-spatial mapping and artificial intelligence to build a better understanding of changes in cropping patterns.

Stay tuned for future blogs about Nigeria’s changing market.

Cover photo by Markus Winkler on Unsplash

VIFAA Going Forward

In November 2022, AfricaFertilizer (AFO), our partner on the Visualizing Insights on Fertilizer for African Agriculture (VIFAA) program, rebranded and launched a new website. This website includes the integration of country-specific VIFAA dashboards, which were previously housed in separate websites. By integrating the country-specific dashboards as well as fertilizer data on trade, production, consumption, and retail prices for 18 countries in sub-Saharan Africa, the new AFO data allows easier comparative analysis across countries and contributes its quota to the advancement of food security throughout Africa.

We have updated the previous country-specific dashboards links to now redirect you to AFO’s new website in order to ensure you are accessing the most up-to-date resources.

Share

Recent Posts

Supporting Ethiopia’s National Soil Fertility and Health Action Plan

Declining soil fertility remains a major constraint on Ethiopia’s agricultural productivity. This blog reflects on the launch of the National Soil Fertility and Health Roadmap and DG’s support in its development, highlighting lessons on government-led reform and long-term resilience.

Development Gateway Collaborates with 50×2030 Initiative on Data Use in Agriculture

Development Gateway announces the launch of the Data Interoperability and Governance program to collaborate with the 50x2030 initiative on data use in agriculture in Senegal for evidence-based policymaking.

Strengthening Online Safety Through Prevention in the Philippines

Tech-Facilitated Gender-Based Violence continues to evolve alongside emerging technologies. This blog explores how preventative measures, such as the Safety By Design approach, can be used to create a safer internet.

Farmer-Centric Data Governance Assessment: A New Paradigm For LMICs

Why a New User-Centric Paradigm is Imperative

The benefits of digital agriculture are prolific. Digitization makes it possible to trace supply chains, treat plants precisely, or obtain data on the status of soil. Digitization holds great promise to modernize the agriculture sector, including by increasing access to finance and helping to combat climate challenges. Data-led efforts are critical, particularly when a lack of access to reliable data threatens humanity. The value of data is unquestionable.

While much data is generated by farmers, it generally is owned and controlled by others. Farmers rely on external resources, like weather data and proprietary tools, that provide specific advisories inferred from data. Yet farmers increasingly lose control over their data and the benefits derived from it. Other dangers exist, with intermediation, opaque data value chains, and dominant market mechanisms. The rapidly increasing data extraction is of great concern, especially in light of current data governance practices, insufficient regulatory guidance, and other capacity restraints. As a result, some farmers are becoming reluctant to share data, also placing them in the position of having to forgo access to beneficial services.

Agriculture’s potential is limited by dominant monopolies and asymmetries of power and information (i.e., when some groups have access to more information than others). The current data economy — certainly at the level of global, big data initiatives — is defined by a paradigm of extraction and a lack of consideration of equity, whereby individuals and communities go unrecognized beyond their use as data points and producers. This has implications on the success of development programs, particularly for economic inclusion and growth.

Reflecting on these issues, many questions arise. For example:

- Who controls the data and what does farm data ownership mean?

- Is it in the interests of smallholders to provide data to firms that share or sell the data with other agribusinesses, banks, or insurers?

- Would it be preferable to retain control and make decisions about how data is used?

- What level of participation should we expect from farmers and farmer groups in data governance?

Why User-Centric Data Governance?

How data is governed informs what products, services, and insights are used and shapes program strategy. Empowering farmers with more control over their data is critical to improve and protect their livelihoods.

User-centric approaches to data governance place farmers, as beneficiaries, at the center of data initiatives which reduces the negative effects of centralized power. User-centric models grant farmers and their communities greater agency over their inputs and outputs and meaningful participation shaped by their immediate needs.

Models like data collaboratives, data commons, data cooperatives, and decentralized data fiduciaries hold the potential to strengthen the position of farmers as equals in future developments. These evolving approaches transition control of data and safeguards against privacy invasion, data misuse, opacity, and other harms. Models can also generate better data sharing opportunities, counter data fragmentation, increase data quality, and identify avenues for innovation.

Farmer-centric, participatory models hold the potential to shift the hegemonic paradigm toward long-term, sustainable, equitable, trustworthy, and more successful solutions. Greater participation in the creation and implementation of data governance can bring about greater societal and economic equity and contribute towards increased public confidence in the use of data.

Given the momentum of digital agriculture and investment strategies, it is crucial that equitable models of data governance are placed within the ecosystem as soon as possible. There is a pressing need to unpack these practices, learn about their challenges, and think about measuring their impact. This study attempts to move beyond the theory covered by others to explore the practical implementation in LMICs, their elements of success, with a focus on agriculture.

Who Benefits from Farmer-Centric Data Governance?

- Farmers gain more control and agency over their data, more equality, meaningful participation and representation, bargaining power, alignment with interest, and access to new markets and opportunities.

- Agribusiness, tech providers, governments and development organizations, benefit, among others, from:

- better and more consistent, reliable, recent, higher quality data, enhanced data access and availability, greater data sharing opportunities, enhanced data management, and decreased data fragmentation;

- greater efficiency and productivity, (public) service design and delivery, decision making, situational awareness and response;

- improved mediation and formalized relationships, communication, transparency, meaningful feedback and nurtured trust; and,

- improved reputation, public relations, legal and privacy compliance, responsibility and meaningful corporate social responsibility;

- increased knowledge creation and transfer, research opportunities, value creation and new avenues for innovation.

About the Study

The objective of this study is to showcase opportunities of user-centric models and the enabling environment needed for implementation. In partnership with USAID, BMGF, and DAI, the study conducted by Development Gateway and Athena Infonomics aims to:

- raise awareness around the current data economy and implications of the status quo;

- identify user-centric data governance models and mechanisms, particularly in LMICs;

- place farmer-centric data governance approaches on the radar of primary stakeholders;

- demonstrate purpose, value, and benefits (as well as challenges) of these practices; and

- identify if support for implementation is needed, for whom, and in what form.

Below we introduce a primer of user-centric, participatory data governance. These practices are not exclusive or exhaustive and often seek different objectives. You might already employ a number of these approaches.

Data collaboratives promote collaboration between diverse organizations, harness their collective capacities and insights and enhance access to wider institutional data which would be outside their purview. Data collaboratives provide organizations with an option to decide rules of data exchange. This also provides a way of gaining trust and confidence between stakeholders. The model can be used as a term to describe initiatives where private sector data is combined and shared with a third party who manages access to it, usually to make proprietary or siloed data available to inform research or public sector decisions. Data collaboratives need responsible, tenable data stewards to empower members or the general public.

Data marketplaces are platforms where data providers (sellers) and data consumers (buyers) can meet, match, and trade their respective data assets and requirements. Marketplaces are emerging as new intermediaries and increasingly play a vital role in the data economy. Acting as an intermediary, they may increase willingness to share data. Farmers may also have access to aggregated platform data on key market trends derived from data supplied by its users. Marketplaces empower smallholders, especially in LMICs, by generating and sharing data on prices, transaction history, and demand. Data marketplaces can assist in overcoming economic and environmental challenges, optimize productivity, and cut costs.

Data commons pool and share data as a resource, with a high degree of community ownership and leadership. This approach can address power imbalances by democratizing access to and availability of data. They can be created with a variety of data and governance structures. A prerequisite is that they be stewarded responsibly (for which many refer to Ostrom’s principles). In science communities, research data is often pooled to increase the impact of data held by individuals. The discourse revolves around the learnings of open access and application of new forms of management.

Data fiduciaries are a type of steward acting as an intermediary that manages access to data between individuals and data collectors based on a duty of care. A data fiduciary can be used to create a trusted environment between various stakeholders and assist in overcoming power imbalances. Mediation of data relationships through a data fiduciary allows for a representative control model which enables individuals to have more control over how data is used and shared.

Indigenous data governance shifts access and control of data away from governments and others directly to Indigenous Peoples. Considering how withholding information has been used as a vector of control, these approaches illustrate how important data sovereignty can be to self-determination. Here, data stewardship entails governance on behalf of (and by a community in) the entire data lifecycle. The mainstream open data and FAIR data principles discourse have been faulted for ignoring historical contexts and power differentials and propose safeguards in the CARE Principles.

Data cooperatives are voluntary communal pooling by individuals of their personal data for mutual economic, social and cultural benefit, and aspirations of a group through a united, jointly-owned, and democratically controlled autonomous association. The model works when stakeholders can be given an equal opportunity in organization and management and have a collective interest. Data cooperatives grant farmers more control over their data; they can manage, curate, and protect access to their data. At the same time, it offers an innovative approach to foster direct engagement and represent interests. Cooperatives come in many forms as they evolve out of the needs of their members.

General Actionable Principles

- User-centric models should be integrated into digital agriculture technology programs. These models have immense potential to shift the current paradigms of information imbalances to benefit farmers, communities, and societies. User-centric models can empower individuals to gain more control and ownership over their data, create individual or collective agency and negotiation power, and protect against data misuse.

- Farmer-centric data governance approaches pursue more consistent and higher quality data sharing, interoperability, and defragmentation. Its impact is dependent on whether design, deployment, and implementation are made collaboratively, building on a foundation of trust. This creates true incentives and can overcome the increasing unwillingness of farmers to share data.

- Meaningful participation must strongly tie inputs and outputs of farmers to data governance. Farmers and their communities should have visibility into practices and avenues for voting, inquiry, redress, and rectification. Feedback should contribute to decision-making and strategic direction. This requires close monitoring to ensure not only that these requirements are met but also sustained throughout the entire engagement lifecycle.

- Data stewards play a crucial role as trusted intermediaries between farmers, data collectors, and data generators. Including a steward enables more access to data pooled by farmers, data that can be shared for broader social benefit, and for a better bargaining position. More research is needed to conclude exact fiduciary relationships and roles of data stewardship.

- Trust needs to be fostered. The need to establish and maintain trust is foundational for success in any engagement, if digital AgTech and data are to transform agri-food networks. Efforts that integrate data and data collection products must clearly explain what activities are being undertaken, their benefits, privacy measures, and the process as to how questions and concerns are addressed and resolved; all of this needs to be included not only at the start of an engagement, but with a plan to maintain these conversations and services throughout.

- Center local context and culture to determine outcomes, implications, and impact when considering models. Farmers are not homogenous, and their needs vary even on a local level. Women and Indigenous Communities often lack representation and agency. User-centric models may very well help, but should not be rolled out in a generic fashion. Context helps define and decide which approaches are most appropriate. Even the best-fit model can bring harm if it is seen to compete with or supplant existing and trusted community dynamics.

- Prioritize existing practices in the communal governance and their research in LMICs, rather than approaches that strongly reflect Anglophone, Western concepts. Data and information sharing in agriculture often happens via less formal constructs. Language barriers constrict examining resources on experiences outside the expected avenues. Communities often know best how to organize and govern resources. Research and implementation need to follow systematic observation of diverse communities with different vantage points in multiple case studies.

- User-centric models are not a panacea ‘one-size-fits all’ solution. Data governance applications tend to be hybrid, iterative, and adaptive. The practical implementation is a lot more ambiguous and variable than theory often suggests. A meaningful farmer-centric data ecosystem can only be built on a range of models and mechanisms. Multi-level governance is an important component of successful engagement. It is important not to get carried away by any hype, instead focus on identifying exactly what is needed.

- More research is needed to identify training and capacity building requirements and financial sustainability. The data governance models showcased here are the most prominent examples in an expanding field of opportunities with a newly emerging set of organizations specialized in different avenues of data governance. There is a need to develop data governance skills training aimed at farmers and the development community to assess and capitalize on user-centric data governance opportunities.

Share

Recent Posts

Supporting Ethiopia’s National Soil Fertility and Health Action Plan

Declining soil fertility remains a major constraint on Ethiopia’s agricultural productivity. This blog reflects on the launch of the National Soil Fertility and Health Roadmap and DG’s support in its development, highlighting lessons on government-led reform and long-term resilience.

Development Gateway Collaborates with 50×2030 Initiative on Data Use in Agriculture

Development Gateway announces the launch of the Data Interoperability and Governance program to collaborate with the 50x2030 initiative on data use in agriculture in Senegal for evidence-based policymaking.

Strengthening Online Safety Through Prevention in the Philippines

Tech-Facilitated Gender-Based Violence continues to evolve alongside emerging technologies. This blog explores how preventative measures, such as the Safety By Design approach, can be used to create a safer internet.

DG at the African Green Revolution Forum (AGRF)

Representatives from Development Gateway: an IREX Venture (DG) will be attending the African Green Revolution Forum (AGRF) from September 5-9 in Kigali, Rwanda to highlight two projects: the Visualizing Insights on African Agriculture (VIFAA) project and the Farmer-Centric Data Governance Models project.

Expanding VIFAA

Visualizing Insights on Fertilizer for African Agriculture (VIFAA) was originally designed as a four-year program to holistically address the supply, demand, and use of fertilizer data in sub-Saharan Africa (SSA). VIFAA focuses on better aligning the fertilizer data supply with information needs in Kenya, Nigeria, and Ghana, bringing together disparate data from existing sources and investing in innovations for filling priority data gaps. In 2022, the program was expanded to include five additional countries: Ethiopia, Malawi, Mozambique, Senegal, and Zambia.

Launching the New AfricaFertilizer.org

AfricaFertilizer.org will provide fertilizer data on 25 additional SSA countries in addition to integrating the current data dashboards for Nigeria, Ghana, and Kenya. Users of AfricaFertilizer.org will have the ability to customize data visualizations for cross-country comparison and access timely information on fertilizer markets. Within the platform, trade, consumption, production, and price data will be available.

AfricaFertilizer.org will display the recently launched Africa Fertilizer Watch dashboard, a visualization of how the Russian invasion of Ukraine has impacted the fertilizer markets of 10 countries in Eastern and Southern Africa. The Africa Fertilizer Watch dashboard also includes indicators tracking overall market risk, affordability, availability, and distribution of fertilizer. Russia’s ongoing attacks in Ukraine have caused severe fertilizer shortages as most countries in SSA rely on fertilizer imports for growing crops. This new dashboard provides transparency for decision-makers to better navigate supply chain disruptions and ensure fertilizer availability.

Remote Sensing and Machine Learning in Cropland Mapping

In Nigeria and Ghana, basic statistics on hectares of cropland and major crops are outdated, if they exist at all. Availability of reliable and up-to-date land and crop usage data will help inform the government and private sector on how to allocate investments to strengthen the agriculture sector, in particular ensuring that the availability and variety of fertilizer products meet market needs.

Through VIFAA’s innovation fund, DG generated comprehensive cropland under production maps for Nigeria in collaboration with machine learning and satellite imagery experts, Quantitative Engineering Design (QED.ai). The updated map provides information on:

- the total land under production across all crops in Nigeria,

- what percentage is under production versus uncultivated, and

- how production breaks down by state and geopolitical zone.

The dashboard and use of innovative tools to fill data gaps are resulting in better-informed decisions across Nigeria’s fertilizer sector. In 2021, DG expanded this work to map all croplands and calculate cropland estimates across Ghana.

Launching the Farmer-Centric Data Governance Models Report

While at AGRF, DG is also invited to launch the Farmer-Centric Data Governance Report, which was researched and prepared in partnership with DAI, USAID, and BMGF.

Background on Farmer-Centric Data Governance Models

While new technologies and opportunities for data have given rise to more accurate predictions and profitability, farmers are increasingly losing control of their data and the benefits derived from it. How data is governed informs which products, services, and insights are used and shapes programmatic strategy. For farmers, the increase of data collection, storage, and use by third parties is of great concern in regards to ownership and governance, insufficient regulatory guidance as well as literacy and capacity restraints. Farmers may be reluctant to share their data, particularly if it will be used and owned by someone else, which may position the farmer to have to forgo access to beneficial digital services.

The agricultural sector’s potential is limited by dominant monopolies and asymmetries of power and information (in other words, when certain groups have access to more information than others). The current data economy — certainly at the level of global, big data initiatives — is defined by a paradigm of extraction and a lack of consideration of equity, whereby individuals and communities go unrecognized beyond their use as data points and producers. Empowering farmers with more control over their data is critical to improve and protect their lives and livelihoods. Employing data governance approaches grant farmers greater agency over their contributions and meaningful participation shaped by their immediate need, thereby, rebalancing power asymmetries in profound ways.

Our Objective

This report presents our findings and recommends new ways of approaching data governance. It aims to:

- raise awareness around the current data economy and implications;

- identify user-centric data governance approaches (in particular in LMICs);

- put farmer-centric data governance approaches on the radar; and

- demonstrate purpose, value, benefits, and challenges of these practices.

About the Partners for VIFAA

International Fertilizer Development Center (IFDC) – As an independent non-profit organization, IFDC works throughout Africa and Asia to increase soil fertility and develop inclusive market systems. Combining science-backed innovations, an enabling policy environment, holistic market systems development, and strategic partnerships, the organization bridges the gap between identifying and scaling sustainable agricultural solutions, resulting in improved household food security and enriched family livelihoods around the world. Using an inclusive approach, IFDC employs locally driven solutions that are environmentally sound and impact oriented that bring change at local, regional, and national levels. More at https://ifdc.org.

AfricaFertilizer.org (AFO) – the premier source for fertilizer statistics and information in Africa. It is hosted by IFDC and supported by several partners, key among them being the International Fertilizer Association (IFA), Argus Media, and the Bill & Melinda Gates foundation through Development Gateway under the VIFAA program. Since 2009, AFO has been collecting, processing, and publishing fertilizer production, trade, and consumption statistics for the main fertilizer markets in sub-Saharan Africa. AFO has an extensive network of fertilizer industry players in the main fertilizer trade corridors and maintains key information on the major producers, their production facilities and capacities, importers/suppliers, and various distribution channels. More at https://africafertilizer.org.

Athena Infonomics – is a data-driven global consultancy that combines social science research methods and ICT tools to drive innovation in policies, processes and programs in global development. They play a supportive role for the written components and research behind the Farmer-Centric Data Governance Models Project. More at https://www.athenainfonomics.com.

Share

Recent Posts

Supporting Ethiopia’s National Soil Fertility and Health Action Plan

Declining soil fertility remains a major constraint on Ethiopia’s agricultural productivity. This blog reflects on the launch of the National Soil Fertility and Health Roadmap and DG’s support in its development, highlighting lessons on government-led reform and long-term resilience.

Development Gateway Collaborates with 50×2030 Initiative on Data Use in Agriculture

Development Gateway announces the launch of the Data Interoperability and Governance program to collaborate with the 50x2030 initiative on data use in agriculture in Senegal for evidence-based policymaking.

Strengthening Online Safety Through Prevention in the Philippines

Tech-Facilitated Gender-Based Violence continues to evolve alongside emerging technologies. This blog explores how preventative measures, such as the Safety By Design approach, can be used to create a safer internet.

Episode 4, Season 1 | Digging Deeper in Agriculture

In Episode 4 of Data… for What?!, Development Gateway’s new podcast, Josh Powell talks to Charlene Migwe-Kagume about our past successes in the agriculture sector, how DG is prioritizing our work, and what Josh and Charlene see as the future of data & digital in the agriculture space.

You can also listen to Data… for What?! on Spotify, Stitcher, and Apple Podcasts.

DG has worked in agriculture since 2015, but it was only in our last strategy cycle that Agriculture was specifically elevated as a strategic area of focus. That decision was largely shaped by several projects, where our experience as data experts allowed us to support partners to map agricultural data ecosystems, collate and unify data sources, and support specific sector policy and service delivery objectives using data and digital tools. Additionally, we saw agriculture as an under-served sector in data and technology, as compared for example to health and education. We felt that we had a unique contribution to make in agriculture at the beginning of our 2018-2021 strategy, and based on the rapid growth and successes of our work, are continuing to scale our work in agriculture through this new strategy.

Building Trust in Data

Our work in agriculture has made clear that, with the right partnerships, our expertise in data and technology does not require us to become experts in the sector in order to add value. Our success has come from our expertise in data and digital combined with our ability to build trust between partners. For example, through Visualizing Insights on Fertilizer for African Agriculture (VIFAA) program, we worked with Africafertilizer.org and other partners to combine and then validate separate datasets from the private sector, government, and civil society. That collated data has been visualized on dashboards to provide a fuller picture of the entire sector.

We have also built trust in the cashew and seed sector supply chains through improved data governance including MoU’s and data sharing agreements. A focus on improved data governance has allowed us to reduce fragmentation and data silos, which in turn has made data beneficial for decision makers in the private sector as well as those making policy decisions.

What is the Future of Data & Digital in Agriculture?

There is tremendous opportunity for innovation in the agriculture sector, but a few that we are particularly interested in are:

- Ethical Use of Remote sensing and Machine Learning – We have seen significant advances in remote sensing and machine learning, which we have harnessed to provide cropland maps in Nigeria and Ghana for the first time since the 1970s. Innovation can drive down costs and allow for more consistent data collection, which we have seen clearly through the cropland mapping.

- Responsible Data Use – In general, we have increased our focus on responsible data use and data governance and this focus will include the agricultural sector as well. This means looking at data sharing agreements between stakeholders, but also increasingly looking at data governance models that protect smallholder farmers and include them more directly.

- Creating Partnerships and Combined Approaches – We have also seen that there are many paths to impacting smallholder farmers. Historically we have focused more on upstream policy interventions and support to the private sector that have the trickle-down effect of helping the farmer. As we move further into digital innovations, we anticipate that there will be more opportunities for DG to work directly with smallholder farmers.

We are taking a two week break from the podcast to take this conversation about our work in agriculture to in-person presentations and conversations at AGRF. If you are there, please connect with DG! Otherwise, we will be back in a few weeks for our final episode in this series where we will discuss digital transformation.

Share

Related Posts

Episode 4, Season 3 | Expanding into Climate Action: How Every Organization has a Role to Play

In episode 4, Season 3 of “Data…for What?!,” host Vanessa Goas and special guest Roshan Paul, Former Director of Leadership Practice & Climate Talent Initiative at IREX, discuss the Climate Talent Initiative, which is IREX’s first in-house climate program.

Episode 3, Season 3 | Context and Climate Action: A Conversation between the Local Development Research Institute and DG

In episode 3, Season 3 of “Data…for What?!,” DGer Charlene Migwe-Kagume and special guest Leonida (Leo) Mutuku discusses LDRI’s early warning system, an AI tool that is being used to enable farmers to plan and manage their harvest more effectively by using local and global data on weather patterns, crop yields, etc.

Episode 2, Season 3 | The Great Green Wall: How Data Can Advance One of Africa’s Most Ambitious Efforts to Combat Climate Change

In episode 2, Season 3 of “Data…for What?!,” host Vanessa Goas and special guests former DGer Joshua Mbai and Gilles Amadou Ouédraogo, Programme Management Officer for the Great Green Wall Accelerator at the United Nations Convention to Combat Desertification, discuss the Great Green Wall Initiative, the Great Green Wall Observatory, and how the the United Nations Convention to Combat Desertification and DG are committed supporting new and ongoing efforts aimed at combating climate change.

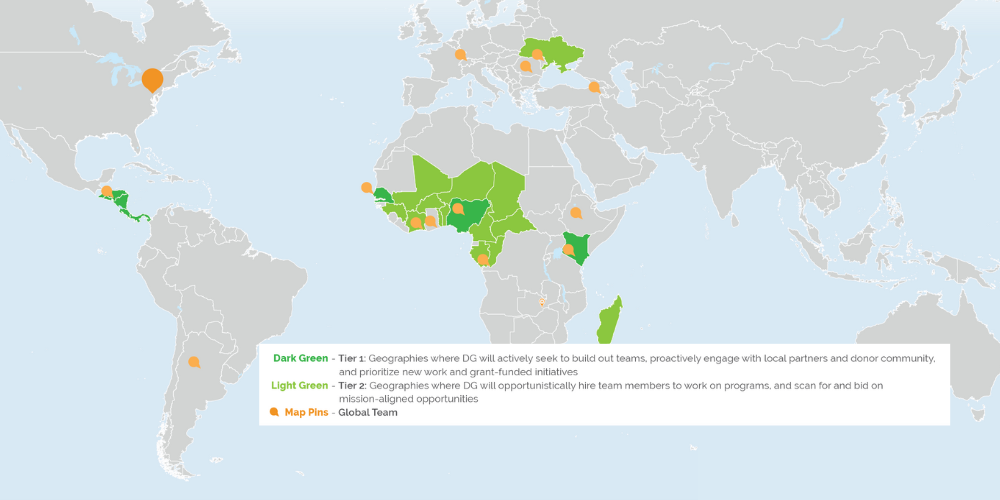

Episode 3, Season 1 | Geography: Expanding & Deepening DG’s Regional Footprint

In Episode 3 of Data… for What?!, Development Gateway’s new podcast, we continue to contextualize our new Strategic Plan. In this episode we explore how we plan to prioritize the regions in which we will work in the coming years through conversations with Vanessa Baudin Sanchez, Carmen Cañas, and Charlene Migwe-Kagume. The conversation highlights our plan to expand our portfolio in Central America and deepen our work and partnerships in West, East, and Southern Africa.

You can also listen to Data… for What?! on Spotify, Stitcher, and Apple Podcasts.

Since 2005, one of our primary points of entry into working in new countries has been DG’s Aid Management Program (AMP). The AMP program has been a way to meet partners and better understand the country and context, and new opportunities have flowed from there. However, that approach has historically been more opportunistic than strategic. We have learned a lot from working in 75 countries, but in the last strategy cycle we made an intentional effort to narrow our regional scope and focus on areas where we had existing team members and we thought we could make a deeper, sustained impact. We have found that the ability to work repeatedly with the same government partners builds trust, understanding of the context, and makes it easier to deliver results. In our new strategy we plan to deepen and expand our work in East and West Africa, but also through our partnership with IREX to start working in Central America too.

Expanding into Central America

In the past 20 years, there has been a shift in international development funding in Central America as some donors have sought to limit their funding and others have doubled down. Additionally, the region is experiencing a degradation of democracy and various factors influencing instability. At the same time we see significant opportunities to support the region. First, through our partnership with IREX, which already has a presence in the region and programs in many Central American countries. Second, the combination of Central America’s still emerging tech sector and portions of DG’s tech team that are fluent in Spanish (based in Argentina) creates an opportunity to put DG’s expertise in digital and data to use. Finally, from our previous work globally, we have learned how to invest in institutions and people in a way that survives political instability.

Building on Our Work in West & Francophone Africa

We hear from partners and funders that DG is unique for our work in West Africa, as many peer organizations have struggled to work sustainably in the region. We attribute a significant portion of our success to having a team based in West Africa that is fluent in French and local languages. Understanding the local context and being able to scale, flex, and adapt our work to each country and sector has been crucial.

Going Deeper in East & Southern Africa

In East and Southern Africa, DG has been at the forefront of digital transformation, through our AMP program, but also through our work in procurement and open contracting. We have found success through our sustainable approaches including investing heavily in subnational data use and local level capacity building. DG has always designed our tools and approaches with the end-user in mind and now the broader development community is making that shift as well.

Tying it All Together

Our global team members are both curious and eager to learn from one another. While each region has its own unique circumstances, we look for lessons that are cross-applicable. My conversation with Carmen, Vanessa, and Charlene highlighted just how universal some concepts are – for example, data governance, data usability, and sustainability. Additionally, while a team member may be based in Dakar, they often have worked in East and West Africa in addition to other regions globally. All of these experiences combined with our expertise give DG a solid foundation for building a new portfolio in Central America. We look forward to sharing our lessons learned as we expand our regional footprint in the coming years.

Share

Related

Episode 2, Season 1 | “Data…for What?!:” Expanding into Education, Media/Disinformation & Youth

In Episode 2 of "Data…for What?!," a podcast series from Development Gateway: an IREX Venture (DG) which explores our new strategic plan, Josh Powell met with experts from DG and IREX to discuss DG’s expansion into the education, media and disinformation, and youth sectors. The conversations explore the most pressing challenges and greatest opportunities for data and technology to positively impact these sectors and discuss how these trends are likely to play out in the years ahead. Based on these trends, the experts explain the unique fit for DG’s skills and specific opportunities for collaboration that align with the vision of DG’s partnership with IREX, which has a long and successful history working in each sector.

Introducing: Data… for What?!

To help contextualize the new Strategic Plan, we are launching a podcast series called Data… for What?! This series consists of 5 episodes in Josh Powell and Vanessa Goas talk to DGers throughout the organization – as well as collaborators within our strategic partner, IREX - about how and why we prioritized the various elements of the new strategy. In this first episode, we talk to Kristin Lord, President and CEO of IREX about how our partnership fits into the Strategic Plan; and to Aleks Dardelli, Executive Vice President of IREX and Chair of DG’s Board of Directors, about the process of putting the Plan together at this opportune, yet precarious, global moment.

Announcing: Development Gateway’s New Strategic Plan

Building on 20+ years of experience, Development Gateway announces its FY23-25 Strategic Plan. DG will expand its role as a global leader in both data and digital for development, working toward a digital development agenda that builds trust between institutions and the constituents they serve. This strategy lays the foundation for how we will achieve that vision.

What We Know So Far: Best Practices in Developing Data Governance Frameworks

Last year, we wrote about some of the issues and discussions around data governance. As data and technology remain increasingly central to how governments, institutions, groups, and individuals all interact with one another and among themselves, we wanted to update our conversation and outline some of the best practices that Development Gateway (DG) has learned through our data governance work.

Data Governance refers to the processes and systems through which an institution manages its data. Data governance guidelines generally include several different elements: principles, roles, responsibilities, related processes, and tools.

The guidelines are composed of a single document or—more often—are outlined across several related documents, frameworks, and policies. Often (but not always) these guidelines will address some or all core issues of data privacy at the same time, such as issues around the safe collection, storage, deletion, and sharing of data gathered in the course of institutional operations.

Best Practices in Developing Data Governance Frameworks

At DG, we have helped organizations think through how they manage their data and supported them to develop data governance frameworks that work in their specific contexts. We have similarly developed frameworks of our own in our projects. Through our Visualizing Insights on Fertilizer for African Agriculture (VIFAA) program, we worked with partners to develop a governance framework that improves trust in data sharing by clarifying how sensitive data would be protected. The Tobacco Control Data Initiative (TCDI), as one of the first DG projects to include primary data collection, has developed program-wide data management protocols to guide end-to-end data management. These latest efforts are built on a deep history of supporting data strategies more broadly and have helped us identify several best practices when it comes to data governance. Below are a few highlights.

1. Map the structures, and mirror pre-existing processes

In creating data governance frameworks, DG begins by understanding existing roles, responsibilities, and tools using interviews to fill in the gaps. After all, there is little use proposing a governance system that is not fundamentally practical for those who will use it and be guided by it. DG has seen the importance of creating data governance processes that mirror an institution’s pre-existing processes when possible; doing so increases the likelihood that individuals at the institution will follow the new processes and security procedures. In 2020, DG and partners worked with the WHO to identify gaps and opportunities to strengthen implementation of their data sharing policies. By mapping the existing structures, we were able to provide clear practical guidance at different levels of the institution that reflected an understanding of the need to build on, rather than add to, existing data management responsibilities.

2. Put stakeholder relationships at the center

Putting stakeholder relationships at the center of data governance frameworks helps connect the dots between mapping existing structures and figuring out how to transform them. DG worked with organizations to help them identify and design risk mitigation strategies through the co-development of data management protocols or memorandums of understanding which safely manage data and maintain trust with data sharing partners. For example, through VIFAA, we developed a data management plan with stakeholders which helped the private sector feel comfortable sharing their data. This plan also doubled as an opportunity to support our partners in strengthening their data management practices.

3. Follow data privacy law or, in its absence, create best practices based on exemplary laws in other contexts

From Kenya to India, countries are adopting national data privacy laws at great speed. However, when there are no local, national, or regional laws that address data governance, DG recommends identifying such laws in other contexts that provide the highest level of privacy protection and security as well as incorporating key guiding principles outlined in these laws. For example, the EU General Data Protection Regulation (GDPR) is one of the most detailed laws and can act as a guide on how to approach storage, sharing, and disposal of data to help frame a rigorous governance approach that satisfies partners worried about their data falling into the wrong hands. Importantly, when the actors create best practices based on GDPR or similar legislation, they must adapt these best practices to the context in which they are working, as certain aspects in the model legislation might not fit.

4. Stay local

When an international organization, governing body, or other institution is gathering data, our recommended best practice is to emphasize keeping the governance of data at the local government level in order to promote data use and strengthen local data ecosystems. DG recommends that this localized ownership of data is planned from the beginning of the data gathering process. Through our work on the Cashew-IN platform in partnership with Cultivating New Frontiers in Agriculture (CNFA) and the US Department of Agriculture, we are working to improve the availability of data for the cashew sector in West Africa. The data governance plan includes working through a steering committee in each country made up of sector stakeholders and MOUs with detailed data gathering/retention guidelines to underscore government ownership of final products. Keeping data decisions at the country level rather than the regional/program level has made stakeholders feel more comfortable to share their data.

5. Build protections into tech

In developing specific technological tools, DG has built location fuzzing into dashboards upon request. For example, understanding the need to protect vulnerable individuals, we designed our Premand Neonatal and Maternal Dashboard to protect sensitive location data while still providing enough data to inform decision-making among stakeholders.

DG’s approach to data governance is to empower local entities to own and govern data when possible and to create data governance plans that go beyond minimum legal requirements.

What’s Next in Data Governance?

Creating for Context

Conversation around data governance is moving toward how to create “fit for context,” sector-specific approaches in data governance frameworks. For example, the health sector has historically seen a wealth of detailed protocols (in part because of the high stakes nature of sensitive health data). One of the next major frontiers for sector-specific data governance frameworks is in agriculture. A proliferation of mobile and web-based applications are increasingly collecting farmer data. Guidance is still evolving on how to ensure farmers gain the most benefit (i.e., improved efficiency in supply chains) and not the downsides (i.e., risks to land ownership, exploitation, etc.).

We are starting to explore this in work with USAID that maps farmer-centric data governance models and with IFAD, as they seek to scale digital agriculture approaches across their programs. We are hoping to “watch this space” to see whether and how these program-by-program approaches scale into national and regional policy frameworks. (Learn more about our farmer-centric data governance work here.)

Protecting the Local while Informing the Regional and Global

Thanks to the way corporations work across borders, it is no longer uncommon to see data collected in country A and stored in country B while influencing decision-making in country C. However, because of data localization policies, barriers are often created in sharing this data, and these barriers stymie the subsequent decision-making and policy-making this data could inform. (There is a robust conversation in the private sector about how these barriers to data flows can impact innovation.)

What does the existence of these barriers mean in the open data/development space? After all, in this space, we think about improving regional linkages (e.g., regional crop supply chains such as fertilizer or cashews) which could increasingly require combining data across borders in order to get a fuller picture. However, sharing data across borders also, rightfully, provokes concerns around privacy.

Kenya has started to tackle these thorny issues in the development of accompanying regulations for its data privacy law. DG has worked with the Centre for Intellectual Property and Information Technology Law (CIPIT) at Strathmore to weigh in on several draft regulations on these issues. We have a long way to go to see what restraints make it into the final regulations and how these will be enforced.

Emerging Technologies

Last, but not least, what will it look like to transform emerging technologies such as blockchain, artificial intelligence, and machine learning into practical tools that communities and government officials can use to shape decisions in their daily lives and ensure that governance and privacy models are fit for these new technologies? At DG, we have seen how machine learning models can bypass labor intensive mapping to produce whole countries’ cropland usage with high levels of accuracy.

How could or should this affect who owns, uses, updates, and discards the data behind these models? We are looking forward to these conversations and how these can add to ongoing approaches to finding a balance between innovation and protection.

Conclusion

Data governance approaches are proliferating at national, regional, and international levels, almost faster than we can keep up with. Over the past few years at DG, we have zeroed in on some of the practices that we believe work—namely, centralizing mapping, stakeholder relationships, local ownership, and privacy-forward technology—to help us develop and support strong data governance frameworks. We hope to carry these lessons forward as the governance space continues to shift, addressing new challenges (and opportunities) that arise within specific sectors, across borders, and facing exciting emerging technologies. We will continue to share what we learn as we encounter evolving data governance challenges and hope that you will engage us in conversation as well!

Photo Credit: Donald Giannatti

Share

Recent Posts

Supporting Ethiopia’s National Soil Fertility and Health Action Plan

Declining soil fertility remains a major constraint on Ethiopia’s agricultural productivity. This blog reflects on the launch of the National Soil Fertility and Health Roadmap and DG’s support in its development, highlighting lessons on government-led reform and long-term resilience.

Development Gateway Collaborates with 50×2030 Initiative on Data Use in Agriculture

Development Gateway announces the launch of the Data Interoperability and Governance program to collaborate with the 50x2030 initiative on data use in agriculture in Senegal for evidence-based policymaking.

Strengthening Online Safety Through Prevention in the Philippines

Tech-Facilitated Gender-Based Violence continues to evolve alongside emerging technologies. This blog explores how preventative measures, such as the Safety By Design approach, can be used to create a safer internet.

Introducing: Data… for What?!

In July, Development Gateway: an IREX Venture (DG) launched our new Strategic Plan for Fiscal Year 2023 to 2025. This plan builds on twenty-two years of project implementation experience and policy engagement around the globe. To help contextualize the new Strategic Plan, we are launching a podcast series called Data… for What?! This series consists of 5 episodes in which Vanessa Goas, DG’s COO, and I (Josh Powell, CEO) talk to DGers throughout the organization – as well as collaborators within our strategic partner, IREX – about how and why we prioritized the various elements of the new strategy.

In the first episode, we talk to Kristin Lord, President and CEO of IREX, about how our partnership fits into the Strategic Plan; and to Aleks Dardeli, Executive Vice President of IREX and Chair of DG’s Board of Directors, about the process of putting the Plan together at this opportune, yet precarious, global moment.

Where Are We Going?

Widening DG’s Focus

To understand the new Strategic Plan, we need to discuss the previous Strategic Plan. DG has historically been a technology generalist, but in the last strategy we made a really intentional decision to focus on specific sectors (health, agriculture, and public financial management) and to concentrate specifically in West and East Africa. In addition to our work as implementers, we added a work stream of data strategy and policy. By narrowing our focus in the last plan, we were able to better understand our core value proposition and programmatic offerings. We found that as we worked in fewer regions, more intentionally and deeply, we were able to deliver better change. Now, with our new Strategic Plan, we are uniquely situated to thoughtfully build upon that consolidated base and to scale our impact.

The Current Global Moment

Throughout the conversation, Vanessa, Aleks, and Kristin highlighted the importance of the current moment in global affairs. Between the largest youth population in human history, recent democratic backsliding, societal changes from the COVID-19 pandemic, and more, now is a crucial moment to reassess how we can best use data and digital to solve problems.

A Growth Agenda

In 2020, I wrote that “A global pandemic may not be the ideal business environment to pursue a growth agenda, but we believe that now is the time for DG to be bolder, and that this boldness will require that we also be bigger.” We are explicit in the new strategic plan that we intend to double the size of DG in the next three years. We see that the world and technology are rapidly changing and if we do not match the scale of these challenges and opportunities, and make aggressive strides, we risk not having the impact DG is capable of. This is where the partnership with IREX is important. By growing our work together, we know that we can leverage our strengths for even deeper change.

DG has spent the last few years positioning ourselves for this growth. We have prioritized systems and processes that will allow us to grow while preserving our culture of innovation and learning, the quality of our work, and while remaining a good partner. In many ways, this is not the beginning of a growth agenda, but rather the midway point. We are now in a position to accelerate this growth in a responsible and impactful way.

This growth agenda also means growing our global team. Over the past five years, DG has gone from 50% based in the United States to less than 25% of our team being based in the US. Our team is now based in more than a dozen countries around the world, and we plan to continue that trend in this growth cycle.

The Process

We had intended to release this Strategic Plan over a year ago, but early in the strategy process our conversations with IREX started, and so we put the Strategic Plan on hold. Last October we finalized the partnership and established a new board, which allowed us to restart the strategy process. From a nuts-and-bolts perspective, we worked closely with the board, but we also wanted it to be a broadly inclusive process as well. In the early stages of development we had one-on-one conversations with DGers to understand what the team was seeing in their programming, what they were excited about, what was working and what was not, and where they saw opportunities. In March, we held an all hands meeting to present a general outline, talk about the process, and allow the team to ask questions. In April, the full DG team had the opportunity to read the strategy and make any additional comments. Throughout the process we had many touchpoints for comments from both the Board and from DGers, which was important for shaping the Strategic Plan.

The Partnership

IREX is a crucial part of this strategy cycle, and specifically in our growth trajectory. We have had much interest from other nonprofit leaders in how the partnership came together. This came out in my conversation with Kristin as well. Both Kristin and I agree that the most important part is figuring out what you want to do together and why. From there, it is much easier to select a method of partnership. Kristin also emphasized that there is a spectrum to how a partnership of this kind could look – from full merger to a more dedicated plan of working together.

I hope you will enjoy this podcast series as much as I enjoyed my conversations. Stay tuned next week, when we talk in more detail about expanding our work in education, media and disinformation, and youth!

Share

Recent Posts

Supporting Ethiopia’s National Soil Fertility and Health Action Plan

Declining soil fertility remains a major constraint on Ethiopia’s agricultural productivity. This blog reflects on the launch of the National Soil Fertility and Health Roadmap and DG’s support in its development, highlighting lessons on government-led reform and long-term resilience.

Development Gateway Collaborates with 50×2030 Initiative on Data Use in Agriculture

Development Gateway announces the launch of the Data Interoperability and Governance program to collaborate with the 50x2030 initiative on data use in agriculture in Senegal for evidence-based policymaking.

Strengthening Online Safety Through Prevention in the Philippines

Tech-Facilitated Gender-Based Violence continues to evolve alongside emerging technologies. This blog explores how preventative measures, such as the Safety By Design approach, can be used to create a safer internet.

Price & Availability: the Impact of Russia’s Invasion of Ukraine on African Fertilizer Markets

Since 2017, AfricaFertilizer.Org (AFO), an initiative of the International Fertilizer Development Center (IFDC), and Development Gateway: An IREX Venture (DG) have partnered on The Visualizing Insights on Fertilizer for African Agriculture (VIFAA) program to address key data gaps. The program works in collaboration with and to support the private sector and government to respond efficiently and effectively to changes in the fertilizer market, ensuring that sufficient quantities and appropriate types of fertilizers reach farmers at the right time for planting.

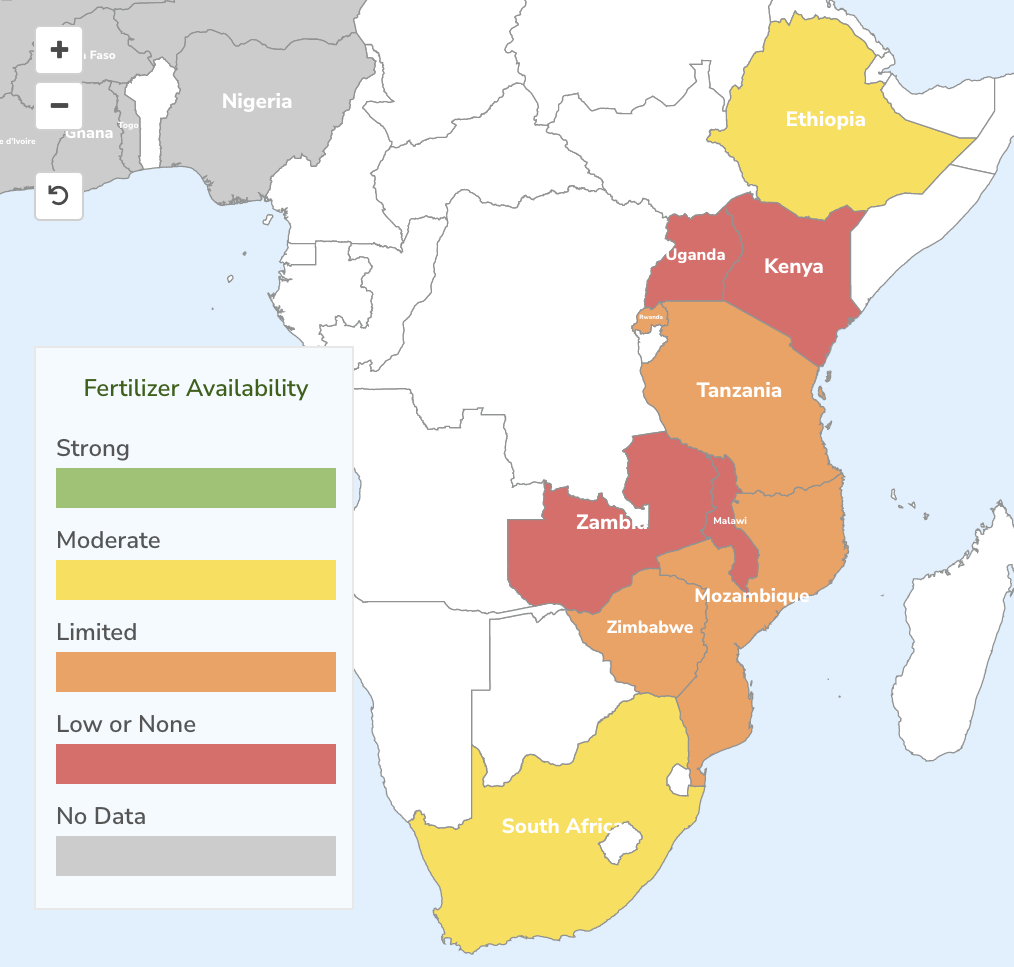

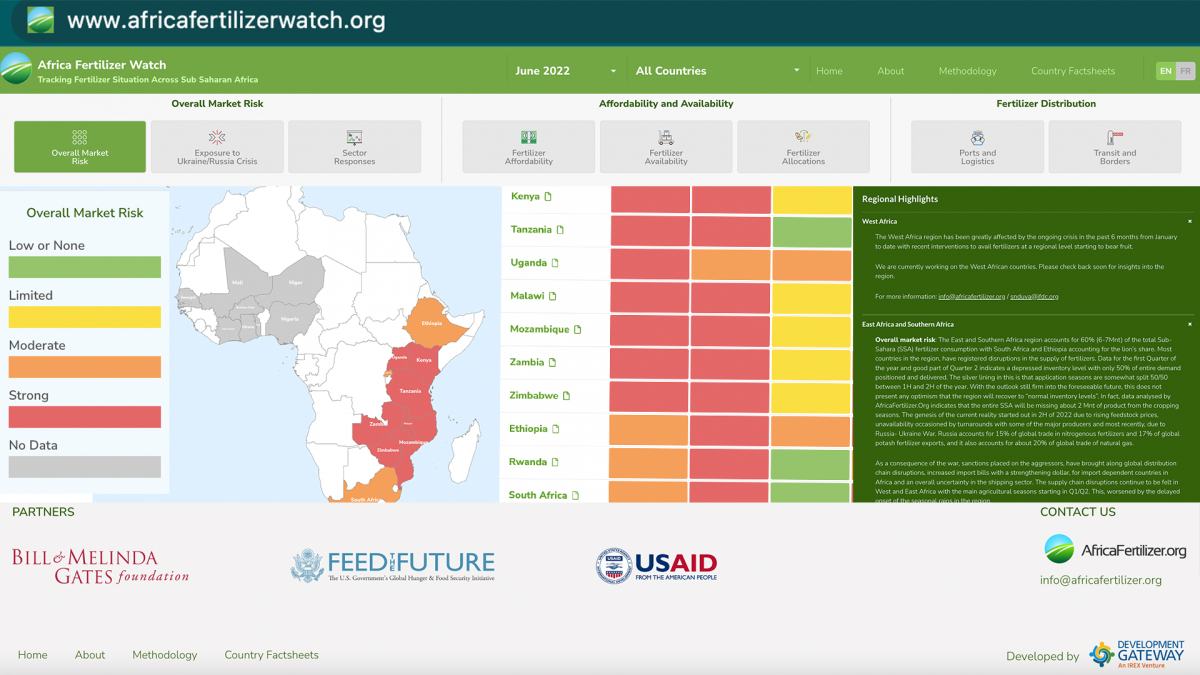

At the country level, the program has developed fertilizer dashboards in Kenya, Ghana, and Nigeria and is currently working on similar dashboards in Senegal, Malawi, Mozambique, Zambia, and Ethiopia. In response to fertilizer availability challenges in sub-Saharan Africa which are fueled by the ongoing Russian invasion of Ukraine (along with a host of pre-existing factors including COVID-19), VIFAA is now launching the Africa Fertilizer Watch to track regional and country-level market indicators, productivity, and production distortions on food production and agriculture.

Background and Crisis

Starting in early 2022, fertilizer prices rose almost 30% due to the Russian invasion of Ukraine. AFO has been tracking data related to price and availability across 20 countries in Africa, and the data shows that fertilizer stocks are problematically low, an urgent issue that was seen during the most recent planting season. The image below shows the levels of fertilizer availability in June 2022, with the majority of countries analyzed having limited or low/none fertilizer supply.

Why Does Fertilizer Matter?

We know that increased fertilizer consumption is one factor that can contribute to food security by improving soil health and increasing crop yields. Prior to the invasion, across sub-Saharan Africa, fertilizer use was already insufficient to replace soil nutrients lost every year to crop production and further constrained by the COVID-19 pandemic.

Eighty percent of the total fertilizer consumed across sub-Saharan Africa is imported. Overall, West Africa accounts for 40% of all fertilizer consumed in sub-Saharan Africa. East and Southern Africa make up the remaining 60%. Nigeria is one of the few countries that does not rely on imports to meet fertilizer demand as they produce 70% of their fertilizer domestically. Currently Burkina Faso, Malawi, Mali, Niger, Sudan, Tanzania, Togo, and Zimbabwe are reporting limited inventory and that they will not be able to meet the needs of farmers in the current planting season. Ghana, Kenya, Nigeria, Mozambique, Zambia, and Malawi (existing VIFAA countries) are also showing a sizable gap in fertilizer supply.

Policymakers must consider how to structure fertilizer subsidies to meet different demand needs across different countries. If the market is adequately subsidized, this usually incentivizes farmers to increase fertilizer use and impacts the amount of fertilizer demanded for each planting season. Whether subsidies in times of crisis have a positive effect on the market depends on a number of factors. Subsidies often distort markets by creating parallel distribution models—subsidized and commercial value chains, often to the detriment of the private suppliers. In times of crisis, the structure of subsidies could be the difference between farmers having enough fertilizer to meet their needs versus experiencing severe shortages. In countries that are subsidizing fertilizer to counter price increases from the Russian invasion of Ukraine, farmers are seeing the benefit.

A Deep Dive

Across sub-Saharan Africa, there are severe shortages of fertilizer coupled with high fertilizer prices. Without interventions, this could have disastrous consequences for food security. An estimate from IFDC shows a fertilizer demand reduction of 30% in 2022 is equivalent to 30 million metric tons (MT) less food produced or the sustenance requirements of around 100 million people. To understand the impacts more clearly, we will use Ghana, Kenya, and Nigeria as illustrative examples – both because of their importance in the African markets and because the VIFAA Dashboards offer a comprehensive picture of the situation.

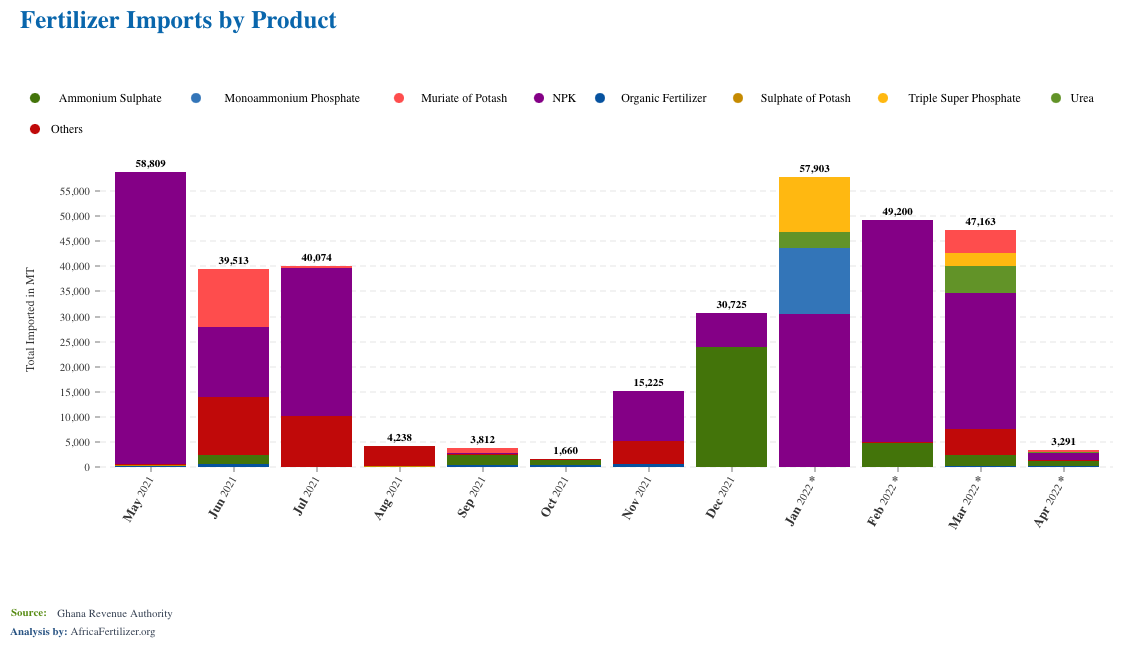

Ghana

Currently, Ghana is reporting only 38% of the inventory needed toward the total 550kt demand. The Ghanaian market is highly subsidized and was already experiencing a 61% reduction in fertilizer consumption in 2021 as a result of existing supply chain issues. The Russian invasion of Ukraine has further impacted Ghana by decreasing the global fertilizer supply and thus driving up the prices on whatever fertilizers are available on the market. For most farmers, the current prices are out of reach. In the image below, the low levels of fertilizer imports from August to December 2021 were due to supply chain issues related to COVID-19. The significant decrease in imports seen in April (see image below) occurred because of the Russian invasion of Ukraine.

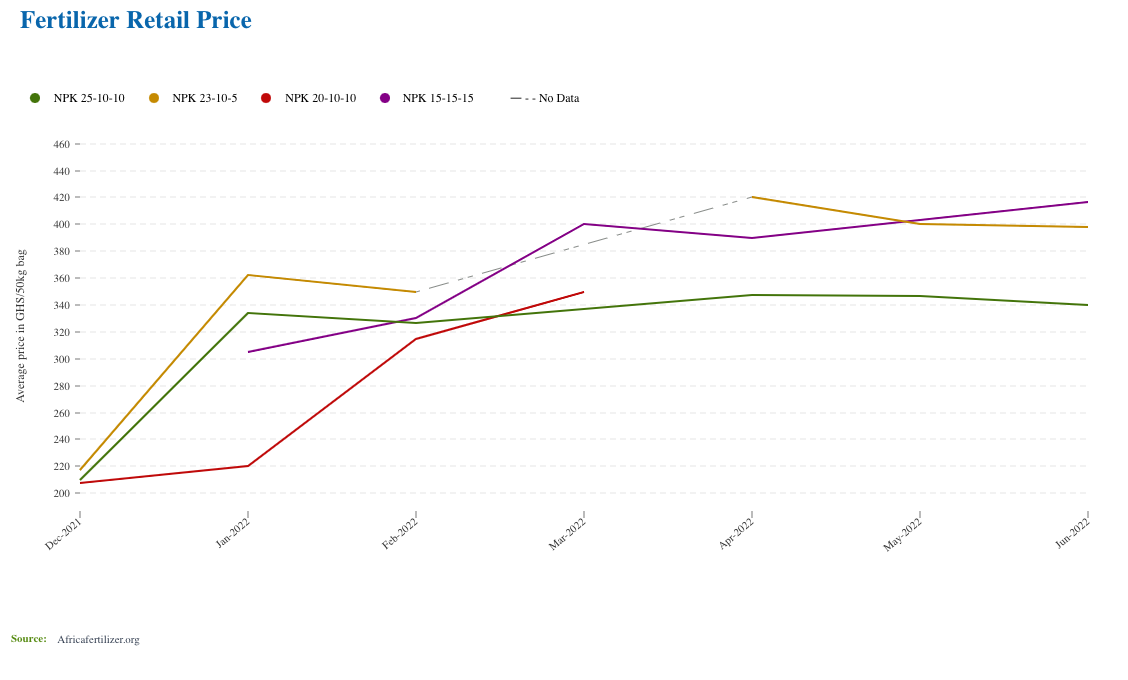

Ghana is particularly reliant on fertilizer from Russia, Ukraine, and Belarus. In 2020, 10% of Ghana’s fertilizer was from the region. That number rose to 18% in 2021 and was at 52% as of May 2022. And as a heavy consumer of NPK (nitrogen, phosphorus, and potassium – key macro-nutrients in crop production), Ghana has been particularly affected.

As the invasion of Ukraine continues, high fertilizer prices and limited availability are exposing Ghana to reduced tonnages, leading to reduced consumption figures and subsequently, lower production yields. The image below shows the steady increase in the price of fertilizer after January 2022.

Kenya

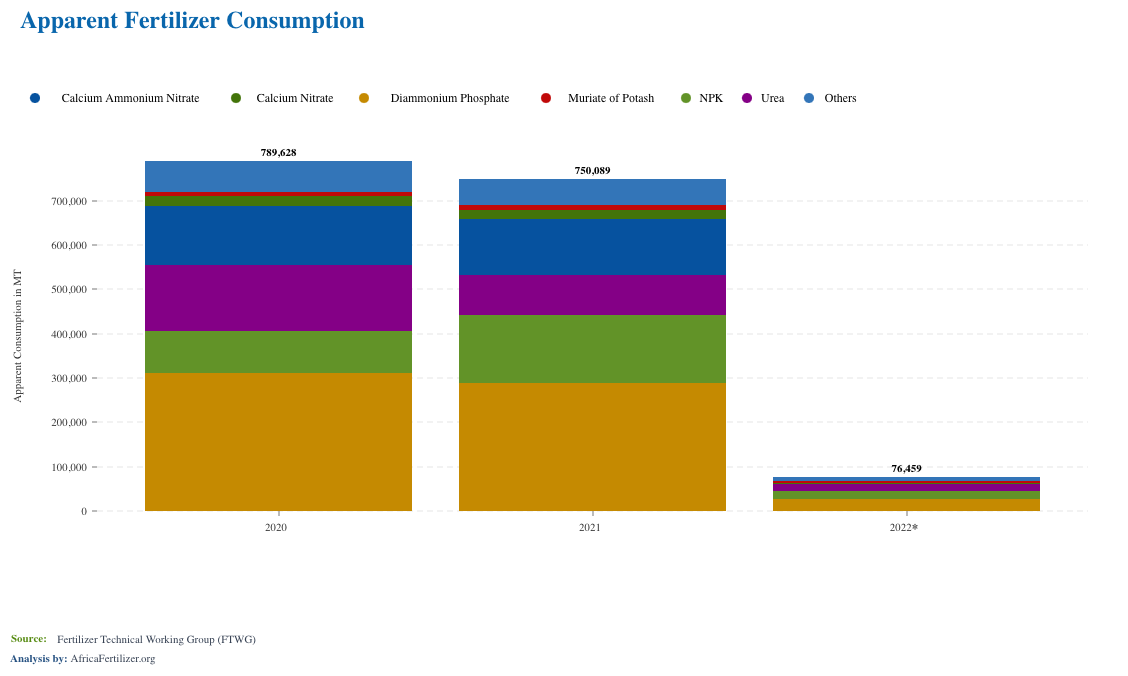

Kenya also has limited access to fertilizer. Like Ghana, Kenya is seeing continued high prices in the fertilizer market. The government has intervened with an emergency subsidy program for 114 KT, but it is unclear if this support is timely enough to address the supply chain issues for the current planting season. The main cropping season in Kenya is May to July. At this point, what has not already been purchased or secured will not be available for the current season. The image below shows the sharp decline in fertilizer consumption in 2022 compared to the previous two years.

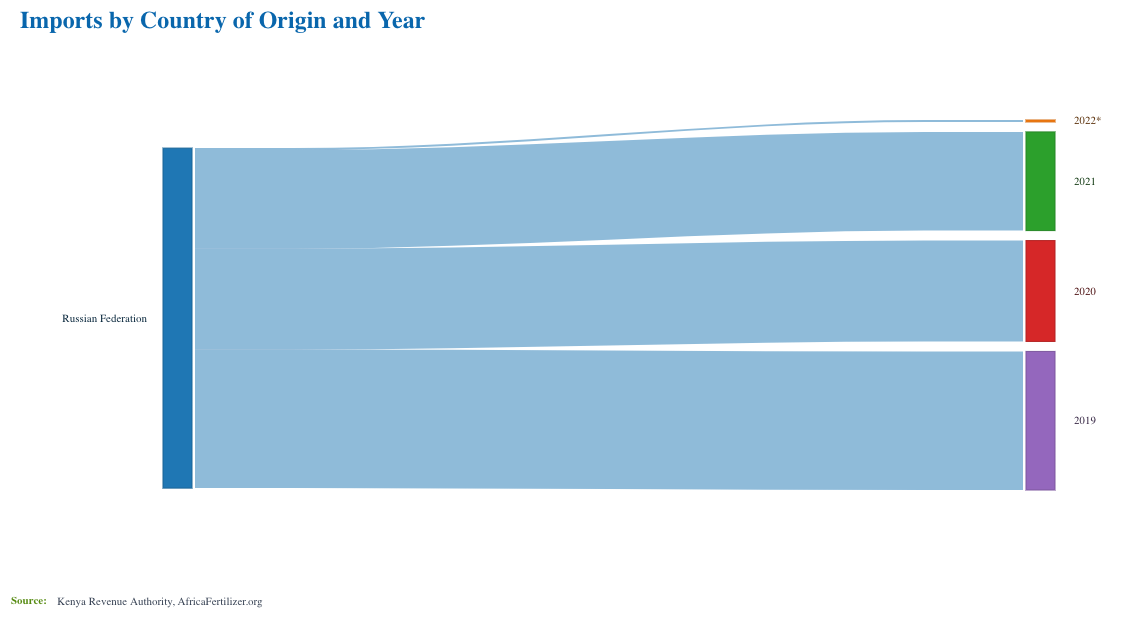

Kenya has historically relied on Russia for a sizable proportion of its fertilizer needs, but has had to readjust due to sanctions on Russian exports. In 2022, there was a sharp decline in fertilizer volumes coming from these countries. Kenya has historically imported all of its fertilizer from Russia for tea production. The rise in fertilizer prices globally means Kenya’s other fertilizer requirements are also challenged.

Nigeria

Fertilizer prices have risen in Nigeria, although it remains one of the few countries in the region that is self-sufficient in fertilizer production. Sixty-four percent of the needed inventory is available for the current cropping season, which provides some stability. Nigeria has also been able to hedge extreme price increases due to the existing 6 MT production capacity for urea. Urea traded locally is cheaper than international prices, giving Nigeria an advantage in terms of affordability because of this large production potential. Nigeria also has an established contract with Morocco to trade ammonia for phosphates, ensuring price stability. Eastern Europe supplies a relatively low percentage of fertilizer to Nigeria. Food security is still a major concern as Nigeria is highly dependent on importing food staples such as wheat and rice.

Muriate of potash (MOP) imports are the most affected fertilizer type with limited availability and record high prices. Without MOP, there will be a nutrient imbalance in Nigeria’s fertilizer blends. Nigeria has made strides in fertilizer consumption through the President’s Fertilizer Initiative (PFI). In the past 4 years of implementation (2017 to 2020), the PFI program facilitated the local production and supply of 1.5 million MT of NPK 20:10:10 fertilizer, resuscitated and established 41 blending plants across 17 states, achieved controlled reduction in the price of NPK fertilizer, created over 250,000 direct and indirect jobs across the fertilizer value chain and accrued substantial annual subsidy and FX savings. However, the current shortages and price spikes could put all the gains made at risk.

Areas of Intervention

Without intervention, the fertilizer shortages caused by the Russian invasion of Ukraine will create a food security crisis in sub-Saharan Africa. The markets in this region are severely challenged in securing fertilizer for this cropping season, which will likely mean scaling down the amount of fertilizer used by farmers both because of the high price of existing fertilizer and limited availability. Ultimately, the reduction will be reflected in crop yields during harvest season. Reduced yields could mean both high food prices and increased food insecurity within the region. This problem is exacerbated by overall price inflation and the fact that most African economies are heavily dependent on agriculture.

There are several interventions to consider:

- Temporary Subsidies – Governments could step in with temporary subsidies to stimulate procurement from global suppliers outside of Eastern Europe. Kenya has followed this route by buying fertilizer at a high cost on the global market and then subsidizing the cost for farmers locally. Tanzania is also considering adding subsidies as a feature of their bulk procurement system.

- Financing – Importers in sub-Saharan Africa are reporting that financing is currently the biggest barrier. In 2021, a 30kt Urea vessel cost $9 million. This year the cost is three or four times that amount. Financiers at this level are unable to match the costs and have had to be creative to keep their businesses alive by, for example, importing smaller quantities of fertilizers at a higher price.

- Tracking Market Dynamics – Closely tracking market dynamics including price and availability can help inform policy and business decisions. We encourage all stakeholders to reference the VIFAA dashboards to inform interventions across sub-Saharan Africa.

- Invest in Production Capacity – In the mid- to long-term, investing heavily in production capacity domestically or at the intra-African level could insulate sub-Saharan Africa from future risks associated with net importers. Nigeria is an example of a country that has reduced its risk related to fertilizer supply. Other examples include Morocco as an exporter of phosphates, and potentially, the Democratic Republic of Congo with potash reserves yet to be exploited commercially.

- Nutrient Use Efficiency – Identifying ways to prioritize fertilizer use for the crop value chains with the highest return on investment for farmers. A massive farmer awareness campaign and support to farmer organizations doing outreach could be beneficial.

The Africa Fertilizer Watch: Tracking Fertilizer across sub-Saharan Africa

In the early months of the COVID-19 pandemic, Development Gateway, IFDC, and AFO developed a COVID-19 Fertilizer Watch Dashboard to support the fertilizer supply chain to visualize related data and respond to the crisis. Similarly, we have developed the Africa Fertilizer Watch to visualize indicators related to the current crisis. The Africa Fertilizer Watch Dashboard will focus on key fertilizer market indicators to support development partners’ and the private sector’s efficient and effective responses to the price increases related to the evolving emergencies and ensure that sufficient quantities of appropriate fertilizers reach farmers in time for planting. This early warning system could inform decisions on subsidies, early positioning of cargo from global markets, credit guarantee schemes, development partners involvement through finance mechanisms, or other interventions to protect fertilizer availability. Indicators include overall market risk, exposure related to the Russian invasion of Ukraine, sector responses, affordability, availability, allocations, port and logistics, and transit and borders.

VIFAA Going Forward

In November 2022, AfricaFertilizer (AFO), our partner on the Visualizing Insights on Fertilizer for African Agriculture (VIFAA) program, rebranded and launched a new website. This website includes the integration of country-specific VIFAA dashboards, which were previously housed in separate websites. By integrating the country-specific dashboards as well as fertilizer data on trade, production, consumption, and retail prices for 18 countries in sub-Saharan Africa, the new AFO data allows easier comparative analysis across countries and contributes its quota to the advancement of food security throughout Africa.

We have updated the previous country-specific dashboards links to now redirect you to AFO’s new website in order to ensure you are accessing the most up-to-date resources.

Announcing: Development Gateway’s New Strategic Plan